Construction Finance

Show your invoice or application and get up to 75% of the invoice value upfront to boost your cashflow. Borrow up to £7 million with Octagon Capital.

- Borrow £50,000 to £7 Million

- Funding available in 24 hours

- Get up to 75% of invoice paid upfront

- Rates from 0.5% to 3.0% per month

- For all contractors and sub-contractors

- UK, Scotland and Wales

- All credit histories considered

Get a Personal Quote

What is Construction Finance?

Construction Finance allows you to get any large invoices paid upfront, so that you can use the money to fund an ongoing project. When taking on a large development job or construction project, you will typically need to stay on top of cash flow and cover costs such as staff, materials, machinery and more.

The construction finance lender verifies that the invoice is valid and can send you the funds within 24 hours. Once the project is complete or part-complete, they collect repayments on your behalf, taking their fees and giving you the balance.

As a customer, you can access funding at the point when an Application for Payment is submitted and receive up to 75% of the invoice value upfront. This offers peace of mind over your cash position and gives you important working capital to complete the project on-time, without the burden of loans or looming repayments. See also invoice finance.

Use Our Construction Finance Calculator

By submitting this form I agree to being contacted by SPF Short Term Finance and I have read and accept the Terms and Conditions.

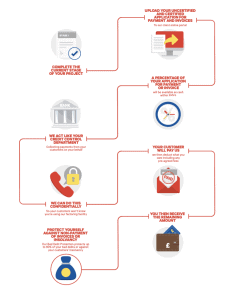

Construction Finance - How it Works Step-by-Step

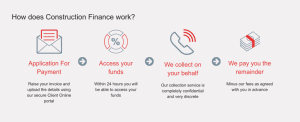

Step 1: Raise your invoice

Upload the invoice details online using our secure portal. Our team will call the invoice provider to qualify the invoice and payment terms.

Your Application for Payment will undergo our underwriting process and we will confirm how much you can borrow, how long for and the rates we can offer you.

Step 2: Receive funds

Octagon Capital can facilitate up to 75% of the value of your outstanding invoice, which can be paid to you in full or in stages. The funds are transferred to your business bank account in 24 hours and this can be used immediately towards your construction project.

Step 3: The construction lender collects on your behalf

When the construction project is complete, we will collect the outstanding invoice payments from the vendor directly. We will recover the interest fees (ranging from 0.5% to 3% per month) highlighted in our original loan agreement to you. Our collection service is very discrete and highly confidential.

Step 4: We pay you the balance

We will pay you the balance, minus our fees. This is sent to you immediately.

Source: Bibby Financial Services

Construction Finance Example

Jimmy Construction Ltd are working on a construction project with a total invoice value of £1 million and need a lot of builders, plumbers and electricians to work on the job. They only get paid upon completion. They apply for construction finance and get £750,000 (75%) of the invoice upfront and use this to complete the project. They get paid the remaining £150,000 minus fees at the end of the term.

Why Would I Need Construction Finance?

When running a large construction project or development, staying on top of cash flow is key. There are a lot of costs associated with running a building project including staff, materials, security, tax, delays, skips, insurance and other unexpected costs.

As a builder, you also rely heavily on the payment terms of the developer who may pay some upfront or only deliver payment upon completion.

Construction finance can help you stay on top of your cash situation. You can validate your invoice with a construction finance lender and they can provide you with up to 75% upfront – which can be used immediately for working capital. You can then receive your full payment upon completion of the job. Simple.

What is the Eligibility?

- For contractors and subcontractors

- For construction services under a contract, framework agreement or Purchase Order

- For UK Businesses trading with other UK Businesses

- All credit histories considered

- Have a valid invoice from a reputable company

- Have confirmed building plans and timescales

- New builds

- Renovations

- Extensions and conversions

- Part builds

- Shops and stores

- Offices

- Residential property

- Commercial property

Why Should I Use Construction Finance Lenders?

Quick Access to Funds – You can upload your invoice to our online portal and confirm the amount you are looking to borrow. Our underwriting team will process your application quickly with a few checks and routinely phone calls. Once approved, we aim to fund construction finance in 24 hours or next business day.

Low Risk – Your loan is secured against the invoice and not assets – there is no repossession of property. There is also added protection against customer insolvency with Bad Debt Protection.

Effective – You can get funds immediately to complete your construction project and complete within the desired timeframe.

Why Should I Use Octagon Capital as My Construction Finance Lender?

Octagon Capital is a specialist finance provider based in London and we are FCA regulated to ensure we maintain the highest levels of quality and reassurance.

We have a proven track record to deliver the funds you need for construction purposes, at affordable rates and flexible terms.

Our confidential services means that your vendors will not know that you are working with us.

And with access to our portal, you have strong control over your sales ledger and can check for updates and manage your credit line as you wish

Construction Finance FAQs

Construction finance is used by construction companies who need help with cash flow to fund a construction project or working capital. If you are running project build and need to cover your costs, you can get up to 75% of your invoice paid upfront to help stay on top of your finances. Then when the job is complete, the invoice is paid in full and you have maintained a good profit margin.

To be eligible for construction finance, you need to be a UK business trading with another UK business. The construction job you are working on needs to have a clear costing and timeframe. The invoice should be legitimate and will need to be validated before funding. We can also facilitate funding for Scotland and Wales.

Octagon Capital can offer construction loans from £50,000 to £7 million at rates of 0.5% to 3% per month. The higher your turnover, the lower the rates you will pay, since it works in economies of scale.

Yes, we are open to working with people with adverse credit, including CCJs.

No, because the loan is secured against an invoice and not a property. You are the construction company and are not securing the loan against the property. We can offer bad debt protection in case the property does not go as planned.

Yes, if you are starting with a plot of land or building on an existing property that you own, you can use development finance, or speak to us at Octagon Capital for more information.