Apply for Second Charge Loans up to 85% LTV

A second charge loan or ‘second mortgage’ from Octagon Capital is a common way to raise finance and release equity from your existing mortgage without remortgaging.

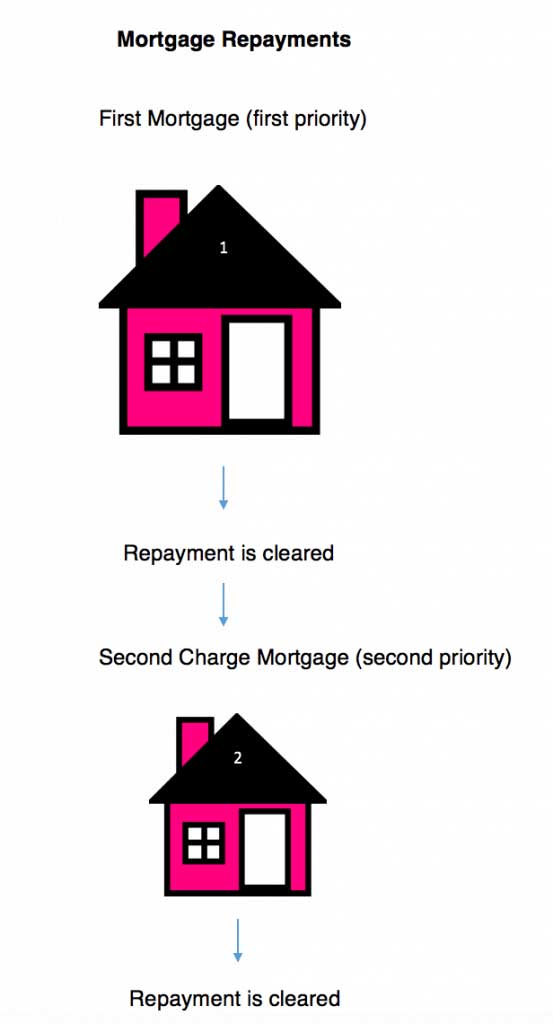

After your first mortgage, it becomes the next priority when it comes to repayments. So when collections are due, the first mortgage repayments need to be cleared and only after can the lender take repayments from your second charge loan.

Get a Personal Quote

Our Key Features

- Secured against your property

- Up to 85% LTV

- Repaid over 3 months to 5 years

- Quicker than a remortgage

- No upfront fees

This type of loan is secured on your first property. A second mortgage does not necessarily mean that you have a second home – you can own one property and take out a 2nd charge in order to access some finance. However, most property developers will typically use this in order to expand their portfolio and buy another residence.

Most types of bridging loans usually fallen under being a second charge loan. It is popular for property developers and investors that already have a mortgage to raise finance for new development projects and opportunities.

A 2nd charge mortgage is still a secured loan on your property, just like a typical mortgage. You have to be a homeowner already to be eligible for this type of loan but you do not need to live in the property as it could be for investment or business purposes.

This form of finance allows you to release equity from your first mortgage and this refers to how much of that property you have already paid for and own. MoneyAdviceService explains that if your home is worth £500,000 and you have £250,000 left to pay on your mortgage, you have £200,000 equity. That means £200,000 is the maximum sum you can borrow. Whilst applying for your first mortgage is usually based your income, credit rating and affordability, the amount you can borrow through a second charge mortgage is assessed largely on the existing equity in your first property.

Borrowers looking to raise finance must be aware that because the loan is secured on their first property, they increase the risk of repossession if they cannot keep up with repayments.

Important Information About Second Charge Loans

This type of finance is usually treated as a simple loan for a certain duration e.g 12 months. The loan is either repaid in one lump sum or interest repayments can be deferred. (Source: Iron Bridge Finance).

However, if the customer has not reached their targets by this timeframe or they are unable to pay back their loan, it triggers a clause in the contract so that the loan provider will get equity in the business instead.

For the borrower, this can be a sign of relief that they are not put into a position of debt and they still have the initial funds to grow their business. The only downside is now that they to give up equity in their company to the lender.

Why Apply for a Second Charge Mortgage?

Raise Finance: Second charge loans are popular for property developers looking to grow their portfolio, especially if they have some extra income and an appetite for growth. It can also be used by existing homeowners to raise money, leveraging the value of the current home. Perhaps they are struggling to get some form of unsecured loans because of their employment or credit rating, but second charges are not as dependent on credit scoring because they are based on the equity in your home. (Source: SPF Loans)

Cheaper than remortgaging: Many people will want to remortgage because their current deal is expiring or they want a better rate. However, if your credit rating has gone down, you may have to pay more interest moving forward, in which case it would be cheaper to get a second mortgage. Similarly, if you want to clear your first mortgage but it has a high early repayment charge, again, it could be more cost-effective to apply for a second charge than a remortgage.

Debt consolidation: A lot of individuals will use a second mortgage in order to receive money upfront which they can use to repay their debts, for things like student loans, credit cards, car finance and other personal loans. This can save the person money by paying off debts and therefore interest is not continue to accrue over time, making the debt more costly.

When Not To Use a Second Charge Loan

Cannot keep up with existing mortgage: If you are struggling to keep up with your existing mortgage, it is risky to apply for a second one because you risk both properties being repossessed if you cannot keep up with your repayments.

What We Offer

Octagon Capital is a registered broker which is approved by the Financial Conduct Authority. As an intermediary, we do not give advice, we can only put you in touch with the best lender that suits your requirements. We have a strong partnership with London-based SPF Short Term Finance who have years of experience handling enquiries for second charge loans. When you provide your details above, your information will be sent straight to one of SPF Short Term Finance’s dedicated advisors and they will help process your application.

Once they have confirmed your details and carried out some relevant checks, they will put you in touch with the best lender that fits your criteria. As part of the regulatory requirements, successful applicants must be offered the loans with the cheapest rates. So you can be rest assured that not only will details be in safe hands but also with the most affordable prices.

What is a Binding Offer?

When you apply, the lender will give you a personalized document commonly known as a European Standardised Information Sheet (ESIS) which:

- Explains the terms of the offer.

- Recaps some of the details of your loan application.

- Summarises features including any fees, the APRC and changes to your monthly repayments if the interest rates rise beyond a particular point

- Provides a reflection period

This document will give you seven days (and sometimes longer) to have a good think about whether or not you wish to proceed. The offer is binding meaning that the rates quoted and amount offered will stand whilst you make your decision. You can choose to proceed or decline whenever you are ready.