What is stamp duty?

Stamp Duty Land Tax is a tax on the purchase of properties. Stamp duty is only paid in England and Northern Ireland. The devolved administrations of Scotland and Wales have alternative property taxes (Land and Buildings Transaction Tax and Land Transaction Tax, respectively). How much tax you owe the government depends on the property value, and where you are in the UK. The temporary changes to stamp duty currently in place only apply in England and Northern Ireland.

What has changed?

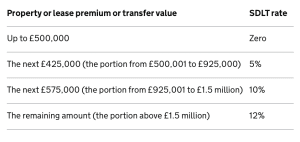

The threshold for stamp duty has been increased temporarily to £500,000 for properties in England and Northern Ireland. This applies to anyone purchasing their primary residence. If your property costs up to £500,000, you will not pay any stamp duty. Higher-value properties will only be taxed on their cost above that amount, potentially saving buyers tens of thousands of pounds.

Before the new policy was introduced in July, buyers paid stamp duty in England and Northern Ireland on land or property with a value of £125,000 or more. The first-time buyer discount allowed those entering the property market to pay no stamp duty up to £300,000 but is now replaced by the stamp duty holiday.

Landlords and second-home buyers will also see a tax cut but will still be eligible to pay the extra 3% stamp duty that has always been allocated to them.

Who benefits?

The stamp duty holiday was put in place to help buyers in a time when many are facing financial hardships as a result of the coronavirus. Chancellor Rishi Sunak has suggested that with the new policy, the average saved on a stamp duty bill is £4,500. Moreover, nearly nine out of ten home buyers this year will pay no stamp duty at all.

While it is aimed at buyers, homeowners are also benefiting and pocketing some extra money. With the policy in place, homeowners have more of an incentive to keep their asking price high, knowing that the buyer is saving on stamp duty. This is particularly significant with the sale of high-value properties which can run a stamp duty bill of tens of thousands of pounds. The stamp duty savings will likely end up being shared, with both buyers and sellers managing to save.

How have house prices been affected?

The Stamp Duty holiday intended to boost the property market after it took a hit during lockdown when house prices fell consecutively for four months. The stamp duty tax holiday has already taken effect by increasing house prices. In August, prices accelerated the most in one month for more than 16 years, according to Nationwide. They describe the sudden recovery as ‘unexpectedly rapid’.

On the other hand, fears have begun to muster that the tax break will encourage those who were intending to buy next year to advance their plans. This could create a vast drop in demand when the tax break ends.

When does the stamp duty holiday end?

The stamp duty holiday in England and Northern Ireland is nine-months long. It began in July 2020 and will end in March 2021. According to HMRC figures, the government usually raises around £12 billion annually from stamp duty land tax. Though, the tax holiday is set to cost the Treasury an estimated £3.8 billion.