What Are Your Rights as a Landlord

With the rental sector enjoying a boom in industry, more and more people are interested in becoming a landlord or are simply curious to what it entails to be a landlord! Specifically, bridging finance is commonly used by buy-to-let investors and property developers who are looking to use the money to purchase a property, develop it and rent it out to tenants (both residential and commercial).

Overall, a lot of the responsibilities in a rental/tenancy agreement lie with the tenant or tenants, and people seem to know the rights of tenants more than they do with the rights of a landlord.

If you are wanting advice on how to evict a tenant and generally want to know about your rights with eviction, click here and here.

What Are Your Rights?

Payment of Rent:

- You should always have a tenancy agreement in place, such as a assured shorthold tenancy agreement. This will initially set out the amount for rent payable by the tenant to you, and when it will be paid.

- It is best to get your tenants to pay the rent to you by standing order, this way you are pretty much guaranteed to get your rent payments each month. Furthermore, you will have evidence of which payments you do receive, and more importantly, the payments you do not receive.

- If you find that you have a tenant or tenants that do not pay you for a set period, and there is no solution forthcoming, then you as the landlord have the ultimate right to serve the tenant or tenants an eviction notice. However, you must be sure to follow a procedure when doing this as explained a bit later on. You can also legally attempt to reclaim any unpaid rent, since it is legally yours.

- Check the terms and conditions laid out by the letting agent before signing an agreement.

Raising the Rent

- You may, at certain points in the tenancy, put up the rent. This will depend on the specifics of the tenancy agreement at hand. You may have to wait for a full fixed term to end before you can make the increase.

- You cannot simply just charge what you want though. The rent has to justifiable, and as do the reasons for upping the rent prices. The rent also has to be similar in comparison to other properties rent prices in the area. Otherwise, you tenant will be entitled to complain and then you will be forced to restore the price of the rent back to an acceptable enough level, or back to what it was before.

Damage and Neglect to the Property

- Unfortunately for your property, damage caused by those occupying the property and their visitors is not uncommon. The damage can easily be by accident, but in some cases it is on purpose. Either way, there will always be tenants who do cause damage to your property and belongings, if the property Is furnished. As a landlord, you may chose to pay for repairs as part of the agreement, this is quite normal – but have the right to evict if you believe major damage was done on purpose.

- Your tenants have a very high level of responsibility to keep the house or flat clean, in good condition and smoke-free (unless your agreement states otherwise). They are also expected to complete the basic maintenance like changing the lightbulbs and using the heating system responsibly. While being a landlord comes with the responsibility of carrying out most repairs, you do have the right to charge tenants for repairs if you see it fit.

- Tenants are obliged to stay within the terms of the tenancy agreement. This includes matters regarding as the keeping of pets – if damage or maintenance is required because of this, again you can take a deduction from the tenant's damage deposit or ask them to pay for the cost of repair altogether, since they have violated the contract.

- However, the exception to all of this is for 'fair wear and tear' such as to carpets or other furnishings – you can't charge the tenant for these since they are bound to be damaged in some way, shape or form.

- If you ever propose to charge a tenant for something of this nature, be sure that you have proof that the damage was caused while the property was occupied by those you are charging. You'll want to take photos to refer to and should properly cost the level of damage caused, complete with quotes to back you up if the tenant chooses to dispute the figure.

- If any damage is considered beyond the 'fair wear and tear' rule and the tenant will not either repair it themselves or pay for the cost of repair, you have the right to serve an eviction notice and retain the sum of money from their damage deposit to cover the cost of the damage and repairing this damage.

- Your last resort may be to go through a legal process to ask the tenant to repair the damage at their expense, but that may not be a viable option as costs could escalate. There are those who specialise in tenant eviction services that could help you through the process of doing so.

Gaining Access to Your Property

- It is actually illegal for you as a landlord and owner to enter your own property without agreement from your tenant prior to asking for access. Landlords do have rights to what is dubbed 'reasonable' access to carry out any repairs for which they are responsible for, but you will always need to get permission from the tenant with at least 24 hours' notice. If you don't follow this process, which can be a simple mistake since it is actually your property, you could be prosecuted for 'harassment'.

As a round up, here’s a quick reminder of what you do NOT have the rights to do as a landlord:

- Visit your tenants without prior warning or good reason, such as an inspection or to carry out duties of repairs, for example.

- You cannot make your tenants leave immediately, or physically force the out of the property and ‘help’ them move out. You must be careful not to make an illegal eviction, this can lead to serious legal action.

- It is a criminal offence to harass your tenants at all, this includes turning up to the property impromptu.

How To Report Noisy Neighbours

Nowadays, it is unfortunate that encountering noisy neighbours is not all that uncommon. You could complaining about noisy neighbours due to loud music being played, parties until the early hours in the garden or inside the house you are attached or directly next door too or pets making extreme levels of noise, especially does barking for hours upon hours.

Noise from neighbours includes:

- Loud music/TV

- Loud talking

- Machinery

- Pets

- Construction work

If you are finding that your home-life and relaxing time is being effected by any noisy neighbours, please take a look at our tips below.

Personal, face-to-face contact

To start off, you may not want to jump straight into reporting your neighbours to the local authorities without direct discussion that may potentially resolve the problem. Reporting them without any communication may cause unnecessary tension between yourself and your neighbours, creating an unpleasant home environment.

It may surprise you that your neighbour is actually unaware of the noise and therefore, disturbance they are causing. They may be unaware that you can hear them so clearly or that it is having a negative effect on you, especially if you are a little quieter than them.

The subject of ‘I think you are a noisy neighbour’ and potentially, ‘all the other people on the same street agree that you are a noisy neighbour’ can be a hard subject to bring up. So, we advise that you approach the situation in a calm, polite manner, whilst remaining firm and unapologetic. Avoided approaching them when in a heated moment as this is likely to cause arguments and create standoffish atmosphere. It is not advisable to phrase it is as a personal attack, or an attack in anyway at all. This will probably lead to them not listening to you properly, but rather being defensive and possibly retaliating.

It is important that if you feel in anyway unsafe approaching them alone, do not do it. However, avoid a whole gang of you going – this will make it feel like an attack and extremely intimidating for the person you are approaching about the noise.

Other personal contact

If you are not confident enough to approach them in person, or it just hasn’t worked, try writing them a letter. Include in the letter that you understand that they are probably unaware of any disturbance caused by them, and you are not claiming it is deliberate or out of spite. But you must explain the situation clearly and why and how it is effecting you and possibly the surrounding neighbours. Make sure you end the letter by thanking them for understanding and not being awkward about. If they do make the effort to comply, please do recognise it – and show your recognition by sending over a small gesture, like a thank you card.

Contacting the local council

Alternatively, if they do not make an effort to change or for some reason it gets worse, you may be forced to contact the local authorities. In the UK, you can report any noisy neighbours to your council through a tool on Gov.uk

Your own local council will have a specific office to deal with noise disturbances in the area. In a lot of cases, is office is located within the remit of the environmental health department, or in larger cities they may have a dedicated noise pollution team. The local police station in your area may also have a dedicated team that works to help and act as the mediator if you and your neighbor are unable to come to an amicable agreement or solution.

Your local council will also advise you to keep a small diary type of thing to record any disturbances. You should keep record of when the disturbance took place, how long you were experiencing the disturbance for and what the disturbance was at any particular time.

Try and keep it as factual as possible. Try a format similar too: Unable to sleep until around 4am, sounds like they had people round until the early hours with loud music – have to get up at 7 for work. Avoid writing down any irrelevant information, like that you are angry or the way you were feeling in general, this will then just turn into what sounds like a personal, everyday journal.

You can even record the noises and the activity using a recording device, a mobile phone or a video digital camera. But it is very important to note that under no circumstances should you publish these recordings or videos, they should only been used as evidence to present to the local council. So do not put it on Facebook, or Twitter or any other social media outlets, ever!

The local council do have the ultimate power to issue official warnings or an ‘abatement notice’. The abatement notice aims to forbid the nuisance from happening altogether or just to restrict it to certain times of the day. If your neighbour fails to adhere to this notice it is actually a criminal offence, leaving them open to a fine. In some areas of the country, councils have the right to get out on the spot fines. Councils are obliged to take action under the Environmental Protection Act 1990.

Getting the police involved

If a noise disturbance happens to play out at night, usually when it happens between the hours of 11pm and 7am, your local police will usually be the ones to take action. They will normally sent a community support officer to take responsibility for taking action on any noise complaints. They will usually be able to intervene to get the music turned down or off, or even help t mediate towards an agreement.

If a noisy neighbour is persistently disturbing the area, it can be seen as anti-social behaviour. If they are in rented accommodation they may be at risk of losing their home, as the landlord may evict them. This applies whether they are in local authority or social housing, or privately rented accommodation.

All of this information provided her applies to all forms of anti-social behaviour, other than violent and threatening behaviour. If there is violent or threatening behaviour report them directly and to the police every time.

For more information, watch this useful video below from an experienced property lawyer:

Getting Security For Your Property

Property security is crucial for properties of all nature; both residential and commercial, public and private. Ensuring sufficient measures are implemented provides property owners with the peace of mind that their property is protected from vandals, intruders, trespassers and squatters. However, there are a wide range of potential measures that can be put into place for the security of properties and it can be difficult to choose from these.

The most common types of security tends to be separated into 2 distinct categories:

- Electronic security: such as alarms and Closed-Circuit Television cameras (CCTV)

- Physical security: such as fencing and barrier security.

Physical security can also include manned security including security guards, site marshals and guard dogs (source: Secure Site). There are advantages to using each type of security with each incurring different costs.

Because of the plethora of options around, it is crucial to understand some of the most common types of each category of security so your property, be it large or small, an office or a pub is suitably and adequately secured when it is vacant. It may be the case that you are in the process of building a new property, having just secured construction finance and you do not want the building site to be unprotected. There are a lot of potentially valuable items and assets on building sites that are appealing to burglars and trespassers.

Electronic Security

This category refers to any electronically powered form of security, of which there are many. Some of the most common types of electronic security are CCTV systems, alarms and lighting; all of which are powerful deterrents and preventers of unwanted visitors, vandals and trespassers.

CCTV Systems – These systems range from basic arrangements where there are just a few cameras that record, not needing to be checked until such time their footage is required to more complex systems that utilise motion detection technology and infrared night vision capabilities. Furthermore, CCTV cameras can be overt (visible to all) or covert [hidden]. The beauty of CCTV is that there are options for residential and commercial properties as well as for building sites. They are an effective way to secure prosecutions as any trespassers or potential burglars are caught on film to be handed to the relevant authorities.

Alarm Systems – Alarm systems are one of the most effective deterrents any site or property owner can utilise. Using motion detection; upon being set, any motion in the areas covered by the alarm sensors will set off the alarm, drawing attention to the site in question. Moreover, many alarm systems are monitored by alarm monitoring companies, sometimes alongside CCTV which allows them to alert the local police to any intruders. Just the site of an alarm box displayed on a property or site perimeter is a strong deterrent to burglars and intruders who tend to steer clear of properties and sites covered by alarm systems.

Physical Security

The most effective and cost-efficient methods of physical security tend to be barrier-related security which forms a physical barrier between any potential intruders and the site or property. Alternatively, for higher value properties and sites as well as those that are suited to it, having security guard, often with guard dogs is one of the strongest deterrents available.

Barrier Security – There are many types of fencing, hoarding and barriers that can be put in place to make intrusion and trespassing extremely difficult. For example, in the case of derelict or empty properties, a popular solution that isn’t too expensive is boarding up all windows and doors with steel or ply-wood panelling. Additionally, for sites where fly tipping, travellers and vehicular trespass are all possible, concrete bollards and hoarding can be implemented, making it impossible for the offending parties to enter without authorisation.

Manned Security – This is one of the most effective methods to protect a site or property; manned security will entail at least one security officer or marshal who will usually be trained to the minimum Home Office Standards (holding an SIA licence) being present on site. They may perform mobile patrols or them may man a static post such as the entrance or other vulnerable point of the site. Sometimes, and depending on the exact arrangement with the security provider, guard dogs may be provided to add an additional level of security.

What is Stamp Duty?

Stamp Duty or and-tax/residential-property-rates">Stamp Duty Land Tax (SDLT) as it is known, is a tax on the purchase of properties and land in the UK and Scotland. It is a one-off lump sum compulsory tax that must be paid within 30 days of completing on a property. For customers taking out bridging finance, it is important that they incorporate the cost of stamp duty into the mix when buying a property and doing any refurbishments or rent out to tenants.

In short, when it comes to stamp duty, the more expensive your property, the more you pay. If you want more than one property, the more you pay. Simple.

How Much Stamp Duty Will I Pay?

The amount you pay in stamp duty will depend on the value of the property you are buying, whereby the higher your spend, the most tax you pay. Following the Chancellor's Autumn Statement in December 2014, there has been a change to the traditional slab system which involved paying a single rate based on the property. Currently, we have a tiered structure which is more progressive and means you pay a portion based on every level.

Based on buying a property for £500,000:

Old system:

- 1% on a property between £125,000 and £250,000

- 3% on a property between £250,000 and £500,000

- So because the purchase price is over £250,000, you would have paid £15,000 in stamp duty.

New system:

- You pay nothing below £125,000, which is £0

- You pay 2% between £125,000 and £250,000, which is £2,500 (based on taxable sum of £125,000)

- You pay 5% on the value of the property above £250,000, which is £12,500 (based on taxable sum of £250,000)

So in total this means you'll pay £15,000 (£0+£2,500+£12,500).

The new stamp duty calculations, whilst they may seem the same for a property worth £500,000, it benefits those buying properties below this. For instance, a property worth £300,000 previously would have incurred a stamp duty fee of £9,000, under the new system would only cost £5,000.

Stamp Duty on Additional Properties

Anyone buying an additional property (in addition to their main residence) will be subject to a much higher stamp duty, provided that the value of the estate is more than £40,000. In some cases, the cost of stamp duty for a second property can be double the cost of the first property's stamp duty.

How Does Stamp Duty Work in Scotland?

The Scottish system does not refer to this tax as stamp duty anyway, following a reform by the Scottish Government in April 2015. It is now called Land and Buildings Transaction Tax and it still functions the same way as stamp duty - everyone has a set amount to pay based on buying a property or land costing more than £125,000.

The only difference with the Scottish system is the thresholds and percentages charged. See below:

UK: £0 - £125,000 (no fees)

Scotland: £0 - £145,000 (no fees)

UK: £125,000 to £250,000 (2%)

Scotland: £145,001 to £250,000 (2%)

UK: £250,000 to £925,000 (5%)

Scotland: £250,000 to £325,000 (5%)

UK: £925,000 to £1.5 million (10%)

Scotland: £325,000 to £750,000 (10%)

UK: £1.5 million+ (12%)

Scotland: £750,000 + (12%)

How To Pay Stamp Duty

Your solicitor that arranges your mortgage and property purchase will usually handle the stamp duty payment. They are usually very eager to get this paid for you which is why some solicitors will ask for the stamp duty money up front - and some will pay it after. By not paying your stamp duty within the 30 day window, you will be subject to the following fines:

| Length of delay | Amount of penalty |

|---|---|

| Documents late by up to 12 months | 10% of the duty, capped at £300 |

| Documents late by 12 to 24 months | 20% of the duty |

| Documents late by more than 24 months | 30% of the duty |

If you want to pay your stamp duty yourself, without a lawyer, you need to find your unique 11-digit reference number (UTRN) which can be found online or via your stamp duty return. You can then pay the HMRC by phone or online through their bank account. Payments can take up to 3 days, so you are recommended to get payment in nice and early to avoid any fines. There are also options to pay by cheque, post or credit card (this will incur a fee). You may be required to present a valid pay-slip if you wish to pay by cheque or post as verification.

Stamp Duty Calculators

A stamp duty calculator can give you a quick calculation based on the cost of your property. We recommend the following tools:

and-transaction-tax-calculator-wales">MoneyAdviceService Wales

and-and-buildings-transaction-tax-calculator-scotland">MoneyAdviceService Scotland

and-tax/#/intro">HM Revenue & Customs

Cost of Moving House Calculator

Other Costs To Be Aware Of

Whether working on a buy-to-let or developing a new property, stamp duty is not the only cost that you need to be conscious of. Other key costs include buildings and contents insurance which will allow you to cover the cost of any potential mishaps to your property development. This can involve any damage to the building by flood, fire, peril, vandalism, fly-tipping or similar. Your contents insurance will cover you for any furniture or items inside that are at risk of theft or even materials used to renovate the building.

Public liability insurance is necessary in case any work carried out by your buildings has a detrimental impact on any neighbours or passersby e.g a roof tile falls and hits the neighbour's car. Your liability cover accepts that you take responsibility and are willing to cover any repair or replacement costs.

When working on a development or property project, it is worth having an extra 10-20% in the kitty for any contingencies. This is extra money in case something goes wrong. For instance, what is you find asbestos on the property and have to hire a professional to remove this? What if there is very bad snow weather and this delays your project by several weeks, requiring you to pay your contractors more? You can never be sure when something unexpected will arise, so having that extra money spare can be crucial.

Other additional fees include the 'arrangement fees' charged by lenders who put together your application prior to funding your purchase. This is part of underwriting and carrying out checks to see if you are suitable for their financial product. This is usually around a 1% fee of the total loan value and is seen as a commitment between you and the lender which is why most lenders require this to be paid before the loan draw down.

Other fees include broker fees of around 2% which are collected upon the funding of a loan. With so many variations and bridging products available, a quality broker can help you source the best provider and save money with the most suitable rates and product.

Further fees include the cost of valuing your property which is required by the lender prior to funding your application. The cost of the valuation may vary based on the value of the property and each lender will use an independent surveyor. This is likely to be also be around 1% of the loan value, but will vary.

Finally, your solicitor will be crucial during the funding process, reviewing the loan contracts, reports from the surveyor and making sure all aspects run smoothly and are paid on time. You will incur solicitor fees, again, depending on who you use and the cost will depend on the complexity and scale of the project.

Property Renovations – What are the Options?

There are many ways in which a homeowner or landlord can renovate their property or group of properties to many ends. A common reason for improving a property is to increase its overall value. This may be prior to a future sale through which the seller wishes to acquire maximum yield or it may be to allow the property to increase its rental yield from tenants.

Whatever the reason for renovating, the options are endless, from quick and easy fixes that will improve the living space in the property to full and large-scale improvements and renovation works that alter and improve the structure, build and design of a part of or the entire property.

Before committing to any work or renovations is always important to assess a number of factors, including:

- Your budget

- Whether you'll be able to afford the works you wish to pursue with or without a loan

- What work you actually want done

- If you can afford a project manager who will help guide you through the entire process and take the weight off your shoulders

(source: Property Perfect Solutions)

It may be the case that you need to take out a specific property loan such as renovation finance to fund such a project (depending on its size and purpose), but the return on the investment may be well in excess of the investment.

Loft Conversions

Loft conversions are a sure-fire way improve the living space in your property, whilst certainly increasing the value of the property. Loft conversions can add potentially more than 20% to the value of your home. For example, if you have a property that is valued at £500,000, a loft extension could potentially increase its sell on value by £100,000 or more. With a loft conversion costing as little as £25,000 from many providers, the return on investment is hugely promising.

There are also various types of conversions and extensions to choose from. For example, if you have a detached property with enough roof space, you may qualify for a mansard conversion which restructures the entire roof and its shape, maximising the amount of space you gain from the works. The walls are built at a specific angle (7°) to ensure maximum space, with resistance to the elements, allowing water to drain off. Other popular loft conversion options include Victorian extensions for relevant properties and bungalow extensions.

Central Heating

Particularly in the UK, there are many times during the year where the central heating needs to be used for prolonged periods of time and this can occur anytime throughout the year in all seasons. Therefore, it is important to have a fully functioning and serviced central heating system. If you are selling your property, it is one of the first things a buyer will look at as it is likely to be well used.

According to This is Money, a new central heating system can add potentially more than 5% to a home’s value. In the case of the previous property valued at £500,000, this means that say the owner cannot afford a loft conversion, installing a new central heating system for around £3,000 could see as much as £25,000 added to the property’s value.

Add a Conservatory

Conservatory styles go in and out of fashion every year. However, one thing that stays constant is their ability to add a fair bit more living space to your property’s downstairs, whilst seeing as much as 5% added to the property’s value. Conservatories also allow a lot more light into the property in question which will make it much more appealing for buyers, particularly those with children who will be conscious of making sure their children receive their vitamin D fix.

The only downside of a conservatory is that you will need to be willing to give up a few metres of garden space to accommodate the new addition to your property. However, this is usually a secondary concern for many homeowners as the value added outweighs the negative feelings around giving up a bit more garden space.

Mortgage Credit Directive Explained

The Mortgage Credit Directive is a legal framework that was put together by the EU to conduct rules for any individual, firm or introducer offering first charges, second charge consumer buy to let mortgages on residential property in the UK. The new legislation was implemented by the Financial Conduct Authority on 21st March 2016.

The new regulation treats first and second charge mortgages equally - so whilst second charge loans used to fall under consumer credit, now any businesses, lenders or brokers offering this service must be authorised and hold the correct permissions for mortgages. For second charge customers, it means that they must now go through the more thorough checks associated with getting a mortgage, rather than a standard loan.

The MCD applies to credit agreements that are secured by a residential mortgage and to credit agreements used to acquire or retain property rights in land or in an existing or projected building. The rules are applicable to the following stakeholders involved in mortgages and bridge finance:

- Credit/lenders

- Intermediaries/brokers/introducers

- Appointed sales representatives

The directive was set up by the EU as part of the G20 commitment to improve the conditions and underwriting of credit agreements relating to immovable residential property (Source: Wikipedia). The decision was aimed to safeguard and prevent irresponsible lending and borrowing in the mortgage markets that caused havoc in the US during the housing crisis of 2006 to 2008, perfectly portrayed in the film "The Big Short."

Overview

The Mortgage Credit Directive sets out some common rules for mortgage lenders and brokers to follow. In doing so, this should create a residential market that better informs customers about the real costs of a mortgage and allow them to compare effectively between competitors. There is a key aspect to reflect on the mortgage contract before going ahead and this is aimed to protect mortgage applications from unfair and misleading practices by firms.

Key Features

The following are adapted from The Government's Guide of EU Mortgage Credit Directive.

Before the mortgage contract is completed, applicants will be provided with a European Standardised Information Sheet (andbook.fca.org.uk/handbook/MCOB/5A/Annex1.html?date=2016-03-21#DES62">ESIS). This is similar to the pre-contractual information that is given to most mortgage applicants across Europe but the ESIS is more detailed.

It includes a seven-day reflection period for the borrower to decide whether or not they want the loan and the EU member state can decide whether to administer this in the pre-sale or post-sale period.

The document includes the impact of interest rates including the Annual Percentage Rate of Charge (APRC) and offers example monthly payments in case they rise to the highest level in the past 20 years. This is a way of saying that 'this is the highest you could pay' in extreme circumstances.

The ESIS must be given in good time before the closing of the credit agreement allowing the customer to compare other rates and ask for third party advice.

Annual Percentage Rate of Charge (APRC)

Part of the ruling of the directive means that customers are presented with the Annual Percentage Rate of Charge (andbook.fca.org.uk/handbook/MCOB/10A/1.html?date=2016-06-30">APRC) and this should allow borrowers to do the following:

- See the whole cost of the mortgage and all fees

- How much the mortgage would cost if you kept it for the full loan term i.e 5 years, 10 years 25 years etc

- Compare effectively against other similar mortgage products.

Example of APRC: Imagine you want to borrow £500,000 with a 25-year mortgage. Halifax charges 1.14% on a two-year fixed rate deal but once the two year period ends, you will be subject to paying the standard variable rate of 4.99%. Therefore as part of the new regulations, the APRC shows you the full cost for the entire loan term as though it were 25 years, giving you an interest rate of 4.6%.

So ultimately the APRC shows you what you would be paying if you stayed with the same mortgage agreement for the entire loan period. However, this is unlikely as people realise that they can save massively by remortgaging at the end of the introductory period. So it is important for applicants and borrowers to look at the introductory rate first, which in this case is 1.14%.

Binding Offers

Mortgage lenders are now required to make a binding offer when providing a mortgage contract. A binding offer is when a mortgage provider draws up a contract stating the terms of the agreement and willingness to lend. It is part of a legal contract but does not become officially legally binding in a court of law unless the borrower accepts and signs the contract. It is common for binding offers to remain open some time to allow the borrower to make a decision and also consider other alternatives.

7 day Reflection period

Customers now have a 7-day reflection period where they can think and decide if the mortgage agreement is right for them. During this time, they can also investigate and compare other deals available. Since this was introduced by the EU, all member states can decide whether they introduce the 7-day period pre-sale or post-sale of the mortgage agreement, or even a combination of the two.

Tying and Bundling

The Directive has strict rules on lenders that want to 'tie' or 'bundle' additional products or services with the credit agreement. This has usually been offered by lenders to diversify and compete with other companies but can also lead to less mobility for customers and the feeling of being tied down. Therefore, the new rulings aim to limit bundling that can have a negative impact on the borrower but also keep anything which may be beneficial.

Property Valuations

Whilst most lenders and brokers already encouraged property valuations prior to forming credit agreements, it is now a requirement to have a valuation that is internationally recognised by the likes of the International Valuation Standards Committee and the Royal Institution of Chartered Surveyors.

Foreign Currency

There are now measures in place to protect those that are applying for loans in a foreign currency. Since exchange rates can fluctuate massively over a mortgage term that lasts several years, there is now an effort to safeguard borrowers from exchange rate risks.

Assessing a Customer's Creditworthiness

Additional guidance has been issued for lenders to assess a customer's credit prior to engaging in a mortgage contract. This can be through the use of credit checking via a credit reference agency such as Experian, Equifax or CallCredit.

The customers’ ability to refinance the credit agreement should be assessed and verified before the conclusion of the credit agreement. The assessment should also reflect on other factors that may inhibit their repayment of a loan such as number of dependents, income, debt to loan ratio and other commitments. Lenders and brokers must look beyond the fact that investing and purchasing a property can generate more income and value and this should not be an excuse for giving credit.

Allow Early Repayment

Whilst already common with most mortgage lenders and providers, customers must now always be given the option to repay their loan early, before the credit agreement ends. In fact, the ability to clear their debts early can play quite a big role when comparing the different rates and cost of a loan. The Mortgage Credit Directive believes that the option to repay early promotes healthy competition in the industry and financial stability within the sector.

Accidental Landlords

The MCD includes new rules if you suddenly become an accidental landlord such as inheriting a property or needing to let out your primarily residence.

This is the first time ever that accidental landlords will be regulated by the Financial Conduct Authority which implies much stricter income and affordability assessments than previously, as though you were applying for a typical mortgage.

The MCD has also brought in new rules if you’re an ‘accidental’ landlord, for example if you’ve inherited a property, or if you plan to let out a property that you have previously lived in as your main home.

However, if you are professional landlord with a limited company and own more than one buy-to-let property, you will continue to fall outside the scope of the FCA. So if you are an accidental landlord, this may be an option to take to limit your compliancy needs.

What About Commercial Property?

The MCD totally excludes commercial property that is used for purchase or buy-to-let. This includes office blocks, shops on the high street, gyms, schools and more.

The new legislation also excludes properties that are 'mixed use' provided that the property is used more for commercial than residential reasons. An example of this is an office building with a flat above it.

The directive also excludes any contract for the purposes of a person's business, trade or professional, assuming that the borrower is not acting as the consumer.

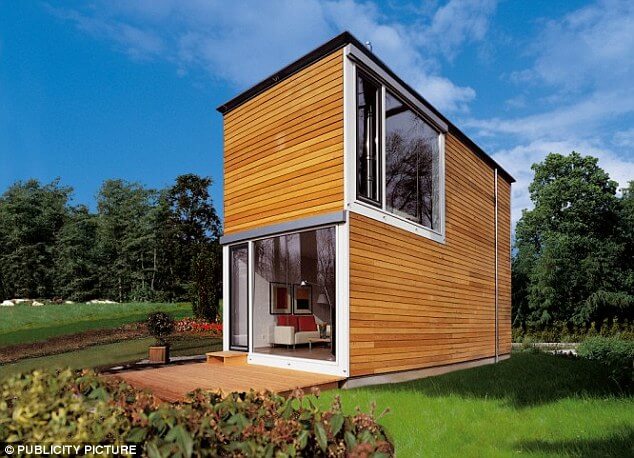

What is Modular Housing?

We recently wrote an article on how the Ealing council was using shipping containers to resolve their housing crisis. Using makeshift containers and portacabins to address the short-term housing needs is a type of modular housing, a craze that is sweeping the UK and redefining how the world builds property.

Modular Housing refers to prefabricated buildings that are made up of different modules and put together. Think of them as big lego pieces to construct a property. Modular homes are typically very small and only used as a short-term residence and way of providing lodgers with the essential living items. Examples of those using modular housing include:

- Soldiers on army bases

- Nurses on hospital sites

- Construction workers on large building sites

- Schools and classrooms

Also known as "prefab homes" or "container homes" they offer a new dimension to the construction world because they are made off site, typically in a warehouse, so you don't have to worry about being delayed by weather conditions. In addition, they take only a few days or weeks to build, speeding up the process by several months or years compared to a regular build.

The constructions are created by the use of computer aided designed (CAD) and the use of 3D printing is helping make great advances in this space. (Source: The Guardian)

Given the fast turnaround and small space requirements, the UK Government has pledged to build 100,000 new modular homes by the year 2020. (Source: The Daily Mail). This is part of Theresa May's larger scale project to add 1 million new homes in the next 3 years.

What Are The Benefits of Modular Housing?

Built in a factory: Being built in a climate controlled area is a huge advantage over traditional stick-built homes. There are no delays due to planning permission or bad weather, meaning that modular buildings can be worked on all year round. Each section moves through the next stage of quality control until they are ready to be transported to the building site and then assembled with cranes. A great example of this was shown in a recent HSBC advert below:

Quick turn around: Modular homes can be built in a factory environment in up to 2 weeks, which is significantly faster than the average home which can take up to a year. It typically takes 2 to 4 weeks for a local builder to complete the home on site once it is delivered, however, this can be shortened with the help of a team.

Energy efficient: The building process is very energy efficient, making use of green materials where possible and allowing people to save on their heat and electricity costs. One of the biggest advantages is that there is no waste to the local environment and above all, no noise to disturb local residents compared to regular site builds.

Help housing: Where housing is scarce or there are not enough properties to service the demand, modular living offers a low-cost alternative to put a roof over peoples' heads. This is why it has been given the go-ahead by the UK Government and will increase significantly across the world over the next few years.

Service remote locations: For work projects that require a lot of staff, there is the opportunity to provide low-cost housing. This will save time and money for employees and save them having to journey in and out of the site. For this reason, we see modular homes being used on big industrial sites, large constructions and even hospitals. The modular homes were used in World War II as a way to accommodate soldiers.

What Are Modular Homes Made From?

The materials used in modular housing are generally the same as a regular constructed home including wood-frame floors, roofs and walls. Depending on the company, some modular homes include brick or stone exteriors, granite counters and steeply pitched roofs.

Modulars can be designed to sit on a perimeter foundation or basement. Modular buildings can be custom built to a client's specifications to include multi-story units, multi-family units and entire apartment complexes.

Are Modular Homes and Mobile Homes The Same?

The answer is no. Modular houses are not mobile homes despite looking quite similar in appearance. They cannot simply be picked up and moved like a mobile home, nor are they on wheels. Also, mobile homes can be full time living quarters whereas modular is intended for the short-term.

One way to decipher between the two is that a mobile home will have a small metal tag outside each section. If this is not evident, you should find the details on the electrical panel box which will also display the manufacturing date. By comparison, modular constructions will have a data plate installed inside the home giving all the information about its manufacture and this will typically be located under the kitchen sink or closet.

Planning Permission For Modular Homes

You will need to speak to your local planning authority (LPA) as to whether you require planning permission. Typically you will need some kind of consent as you cannot just set one up in the middle of the street, park or unused land because this will have an impact to neighbours or land owners.

There are no restrictions if you set it up on a construction site and you are responsible for the entire area. There is limited planning required if the modular construction is just temporary i.e less than 28 days. Click here for more information.

Other Uses

Modular homes are not necessarily a budget form of housing to be used short-term. One German designer has created an artistically edgy building using modules and this is now on sale for around £88,000.

In the trendy Shoreditch area of London, they have developed "Box Park" and used shipping containers as retails shops. It is an effective use of space, low-cost and as they say in that part of town, 'hipster.'

In the US, they are simply making homes using modules. They look like regular homes and similar to the standard American homes made from wood. It is all about creating something in modules and piecing them together - so it doesn't need to be for temporary housing. In fact, using CAD technology and 3D printing, it could be the future of housing as we know it.

The Best Ways To Sell A Home

Most of our customers are taking out bridging loans in order to purchase and develop a new property, flat or house. After spending thousands on renovations, one of the most important things is being able to sell the property at the end. After all, this is where the developer will exit, generate their real income and also be able to repay their bridging loan.

However, one must not take for granted that selling a home is easy. Depending on the property market and the taste of buyers, selling your newly renovated place is not a sure thing. Our guide below gives the best tips for selling your home on the open market, including the following:

- Get the right valuation

- Decide who is going to sell your home

- Get some kerb appeal

- Create a smell

- Give them room

- Choose the best buyer

Get The Right Valuation

One should not simply guess the valuation of their property when they put it out to market or take a valuation based on an online calculator. Some property experts suggest getting valuations from 3 different surveyors and getting their opinion in terms of how much you should put the property on the market for and who is the ideal buyer. Should you be pitching to families? The elderly? Getting the right amount is important especially that potential buyers typically bid underneath the asking price. (Source: Which.co.uk)

Decide Who Is Going To Sell Your Home

This is crucial when selling your home and the most obvious option is to try to sell through your local estate agent. They will know the area very well and what to expect, unless of course you know and live in that area already. Estate agents will also have some very interested buyers on their books already who will be looking to move, maybe chain-free. Not only can they provide you with signage to put in front of your house, they will also give your property exposure in local newspapers, magazines, shop windows and online portals like Zoopla and Rightmove. The only issue with using an estate agent is whilst they might be free or low-cost in the short-term, they tend to charge a sale fee of 1.5% to 2% and this can eat into your profits as a developer.

Other options include trying to sell the property on your own or using new alternative sites like Tepilo or HouseSimple where you pay a one-off fee ranging from £495 to £795 to put your property on property portals like the ones mentioned above. Whilst this is much lower rate and way to avoid estate agency fees, it means that you have to play the agent and show people around the house and book appointments etc. If you have all the information and the charisma to keep up, this can be a viable and cost-effective option.

Get Some Kerb Appeal

This is the term coined to make your house look good from the kerb. This includes making sure exteriors such as the front door, windows, paintwork, front garden and number sign all look presentable for passers-by and potential buyers. These very subtle and cost-effective changes can make a world of difference to the amount of interest that your property gets and since people like their homes to look nice, it can be the difference between a sale and not.

Start by putting some nice flower pots outside your home and making sure that your door looks spick and span. You only get to make one first impression, so make sure that it's a good one.

Create a Smell

Similar to the first impression, visitors get a smell when they work in and the last thing you want is for it to be smelling like your domestic pet or kid's football kit. Give the punters something nice to whiff on with a vanilla diffuser costing only a few pounds from your local supermarket. There are rumours that putting fresh bread in the oven or the smell of coffee can trigger the senses, making people feel at home and more likely to show interest.

Give Them Room

No one likes the homeowner cramping their style. It is important not to hang around or pester the visitors and get them the space they need to look around. It is also essential that you do not seem overly keen or desperate when trying to make the sale as this will give off the wrong vibes and make the buyer think that they can bid lower than necessary, eating into your bottom line.

Should You Try Getting Cash For Your Home?

There are a number of companies that specialise in giving you cash for your home and this allows for a sale within just a few days or weeks, compared to pre-longing for several months. Companies such as Nested and Ask Susan can assist with that quick sale and turn you into a cash buyer very quickly, but just note that they will typically undervalue the property for the convenience of a fast deal. In addition, they may have to take a view on properties with complications.

Choose The Best Buyer

Once the offers are on the table, your next big job is to choose the most reliable buyer. The best ones to have are those that are 'chain free' meaning that they do not need to sell their existing home in order to move into yours. According to statistics, 10% of property buyers in the UK are chain-free.

Being without chains speeds up the process massively and means that they have a good idea of how much they can afford and can also move in as soon as possible. Other good buyers include those in rented accommodation because it also suggests a quick move is on the cards. In addition, those that are cash buyers, meaning that they do not require a mortgage allows for a speedier process and fewer property chains involved.

What Happens If You Cannot Sell?

When you have used a bridging loan to purchase your property and make renovations, you will have around 12 to 24 months in order to make repayment. So the idea is that you make the sale before or around this time so that you can exit and repay your loan.

However, depending on the building work and the demand, there is always the chance that your development does not sell. However, you do have options:

Rent It Out

Rather than sell, there might be a bigger demand for tenants so you can always rent out your property on the open market. Your bridging lender will appreciate that you are still generating income and they will give you options in terms of making repayments.

Sell Through An Auction

If you are desperate to sell, you can auction off the property through the different auctioneers and houses. This has become big business in the UK and through auction finance, people have to complete the entire sale within 28 days or risk losing the property - so it is an effective way to move your estate. The only issue is that people typically go to property auctions to get a discount so you may find that your asking price is cut by 20%.

Refinancing

Bridging lenders will commonly allow you to refinance your loan if you do not sell by the end of the loan term. Of course, there are several factors that come into it such as the state and condition of your project and your plans for it. The terms will likely be different and less favourable, but it still gives you some extra time in order to sell your property and generate a high return.

Ways to Increase the Value of Your Home or Property

At Octagon Capital, we appreciate that the majority of people applying for bridging finance are using the funds to renovate or refurbish an existing property. This could be their own property or one that they are looking to fix up and rent out to the public or resell on the open market.

With this in mind, developers and investors are always going to be looking for ways to add value to a property and maximise their returns. Sometimes there are limitations to how much you can actually add due to space restrictions but some clever ideas mentioned below can help you make the most of your investment, taken Phil Spencer's guide in The Telegraph:

- 1. Loft conversion (20%)

- 2. Add a Basement (30%)

- 3. Convert the garage

- 4. Pave over front garden

- 5. New kitchen (4.6%)

- 6. Add a conservatory (7-11%)

- 7. Have a tidy up

- 8. Add central heating

- 9. Add solar panels

1. Add a Loft Conversion - Increase by 20%

A loft extension is one of the most straightforward ways to increase the value of your home. Whether it is turned into another bedroom, shower room, kids room or home office, you benefit from the additional living space and the best thing is that the work can be completed in a few months without you having to leaving your home. A quality loft conversion starts at around £25,000 for an addition bedroom and bathroom according to Premier Lofts, but this can add 20% to the value of your property.

There are some things you will need to do, such as strengthening the floor joists and raising the floor levels. The best approach to a loft is to make it look natural and not fitted on. You will require planning permission from your local council and the whole process from planning to build can take around one year.

2. Add a Basement - Increase by 30%

This is going to be the biggest factor that can maximise the value of your property development. Ideally you want to get in there early, especially if it is a new build because otherwise all the drilling and work involved will mean that you will have to vacate your home for a period of time.

To calculate the potential return on a basement all comes down to the value per square foot. On average, it costs £200 per square foot to do the digging and then £100 per square foot to do the work, that is how the contractors charge. So unless your property's sq foot is worth at least £300, you will not see a positive return on investment. But, if the neighbouring homes are worth around £500 to £900 sq foot then investing in a basement is a great opportunity and for every £1 you spend, you could be making back around £3.

A basement opens all new kinds of possibilities for living space, extra bedrooms, utility rooms or play rooms. They also look even cooler if you keep the stone brick effect. In Europe and the US, basements tend to come as standard but we seem to be lagging behind in the UK, which makes them all the more unique and valuable.

3. Get Rid of The Garage

Whilst a garage can sometimes be a selling point and way to increase the value of the home, you need to think about it logically. Apparently, 90% of garages in the UK are used and are just filled with junk. So you have to cost it out. If the value per sq foot is valuable in that area, turning the dusty old garage into another living space could be worth a lot. With a standard conversion of this nature costing around £10,000, you need to calculate the potential return. This renovation may not necessarily require planning permission because you are not building on top or extending the property.

4. Pave Over The Front Garden - Worth up to £50,000

Sometimes a front garden can look very nice but if it is only small, it can be a lot of upkeep for very little use. Of course it depends on the circumstances, but in a very busy urban space (like the centre of London), it could be worth paving over the driveway so that you can fit another car on the forecourt. Whilst this could cost around £10,000 to do, extra parking could be invaluable in such a busy area and it can potentially add up to £50,000 to the overall value of the estate.

5. New Kitchen - Increase by 4.6%

The kitchen is pretty much the busiest room in the house, its where you start your day and hang out after school or work. If you are a developer looking to resell or rent out the property, a well-fitted kitchen with modern appliances is essential. This includes sink, taps, fridge, stove and oven - and having the most up-to-date utilities will keep the home in good stead for the next 10 years, rather than being outdated with old appliances.

Whether or not to invest in a new kitchen comes down to the numbers. For instance, there is no point investing in a £25,000 kitchen in a home only worth £250,000 or equally spending £10,000 on a kitchen for a home worth around £1 million as it will bring the value of the home down. You need to find that sweet spot so that it can increase the quality of living and value of your home and doing so can help you add value by up to 5%.

6. Add a Conservatory - Increase by 7 to 11%

A conservatory is a nice additional living space to add to your home and can be used as a TV or eating area. The best ones are those that match the style of the house and become a natural part of it, rather than looking like they have been 'fitted on.' If your garden gets a lot of sunlight, maybe because it is South facing, it will continue to light up your home for extra hours of the day and warm up the house too, so you can save on your electricity and heating. With the cost of a conservatory ranging from £5,000 to £30,000, it can add between 7% and 11% on the value of your home, depending on the quality and build.

7. Tidy Up The Place, On The Cheap

Not all the best ways to add value to a home or flat require spending thousands of pounds. Even just updating the basic aesthetics can make the house seem so much more approachable and perceived more valuable in the eyes of the potential buyer. Our examples include:

- Replacing the front door and garage door with a more modern one

- Replacing doors and doorknobs around the house

- Getting new windows to match the style of the house and double glazing as a minimum is recommended

- Adding a fresh coat of paint to spruce up the exterior

- Planting more flowers in the front and back garden. It does not need to be a landscaping masterpiece but doing to your local garden nursery and picking up some plants can make all the difference.

- Even getting a new house number or signage for the house will make it look superior.

This list is commonly known as 'kerb appeal' which refers to making your house look better to those that see your house from the outside, or 'on the kerb.'

Source: Home Building

8. Central Heating

Although this already may be in your home, it is considered an essential and new tenants or buyers will not want to have to install or pay extra for it. Costing around £1,000 to £3,000, it can add up to £5,000 to the value of your home. And remember that you don't have to pay for a new central heating system all at once, you can pay in monthly installments using boiler financing.

9. Add Solar Panels

A great way to look green and modern, adding solar panels can help you or potential buyers save big on their energy bill. It is a long-term game and may take over 20 years to break even, but there are government grants where you can get solar panels for free and use them wisely can be a good investment. Costing around £5,000 to £7,000 to install, MoneySavingExpert says that you will save an average of £300 per year on your utility bill which equates to around £6,000 of savings over the next 20 years.

10. Things To Avoid

Don't over-spruce: Avoid making the property too valuable and don't go nuts on adding everything under the sun. You have to consider what property prices are worth on that road and that area. If every other home on the street is worth around £500,000, new buyers are unlikely to pay double to be on the same road and it will just be out of place.

Avoid DIY jobs: When it comes to making renovations, avoid using the cheapest contractors or DIY jobs as this may cause more problems done the line for tenants and new buyers if you need to make replacements.

Go easy on the furniture: Although new furniture can make a place look very smart, it does not contribute to the value of the property because new buyers are likely to have their own furniture. Even if they do want it, they will likely want it at a bargain and you may not get exactly what you spent on it.

Ealing uses shipping containers to help housing crisis

With more than 250,000 homeless in the UK and the housing crisis always a pressing issue for the Mayor of London, one council has taken measures into its own hands to solve the crisis. The answer? Modular Housing.

The Ealing Council has erected a number of shipping containers to house 80 homeless people in Marston Court, Ealing. Whilst the idea of living in a shipping container does not sound very glamours, with the help of CargoTeck, the modular homes have been fitted with all the essentials and have been compared to chalets and bed and breakfasts. With interior design and household utilities, the homeless are getting the resources they need to live and survive. The containers look similar to the portacabins used by schools and builders as make-shift offices or classrooms.

The Neighbours Have Complained

Several local residents of the W3 postcode have complained about the recent constructions, specifically what an eyesore they are and how close they are to other residents of Ealing. One resident said that they were promised a new park, trees and shrubbery to replace the disused garages but there isn't any of that. (Source: The Mirror)

It also raises concerns about unsociable behaviour and in an area where there is already too much of it. But above all, it is the proximity of how close they are to local residents which has attracted criticism and they have argued that it was 'not like the original plans.' Neighbours were even more outraged to find out that the site has planning permission to be around for another 10 years - much to their dismay.

The local council have defended themselves, saying that they are the same specification as the original plans. Mark Wiltshire from The Ealing Council explained:

When we put people in bed and breakfast we don't get the full cost back from the government.

So we are subsidising to the tune of about £7million-a-year. So it's a much, much cheaper way to deal with this problem.

And the actually living arrangements are much better for people than bed and breakfast.

Future Modular Housing Plans in Ealing

The council continued to say that this, in fact, one of three temporary living areas that they are expanding, according to ITV News. The aim is to provide emergency homes to those struggling to find places to live and the vision is to also include playground areas, bike sheds and a community for all.

The Facts and Figures

- Marston Court will provide 34 homes which will be used as temporary accommodation for families facing homelessness while more permanent places can be found for them.

- Modular homes are one of the ways the council are working to "boost the borough’s housing supply and reduce the council’s reliance on bed and breakfast accommodation" which is expensive and not ideal for families.

- The homes have planning permission for 10 years.

- The site also features, landscaping, a playground, a laundry room and cycle parking.

- Previously there were garages on the council-owned site.

For more information, you can listen to a full interview with BBC Radio's Vanessa Feltz speaking to the Ealing Council about the site and situation: