Green property in 2021

- The Green Homes Grant has been extended

- Interest in green housing is increasing

- Homeowners have till 31st March 2021 to complete upgrades

In 2020, the government announced an extension of the Green Homes Grant, which attracts landlords to eco-friendly properties. The plan offers a grant to property owners to make eco-friendly renovations on their properties.

The aim is to encourage more property owners to install energy-efficient improvements—for example, insulation, heating, draught-proofing, and double and triple glazing. Renewable energy innovations, like heat pumps or solar panels, also qualify.

How does it work?

The Green Homes scheme offers funding for up to two-thirds of the improvement costs, to the value of £5,000 per household. Homeowners and landlords wishing to use the grant have until 31st March 2021 to get their upgrades completed.

What's the result?

The Green Homes Grant means that making energy efficiency improvements is more accessible. The government's extension of the grant has seen positive results alongside the public's growing awareness of environmental issues.

In 2021, almost 84% of British homeowners plan to address energy efficiency changes in their property, according to a study by City Plumbing.

Nearly 53% of households plan to invest in green measures specifically to reduce energy bills. The home improvements most usually chosen include upgrades to the cavity wall, loft, and underfloor insulation. Improving your property's insulation can have a significant impact on its energy performance.

Evan Maindonald, CEO and founder of MELT Property, believes that buyers are ready to embrace sustainable living.

"If you are looking to improve the energy efficiency of your home, a good first step would be to review your property's heating system. Old-fashioned heating systems will send utility bills rocketing and have a high carbon footprint. To reduce both, consider installing an Air Source or Ground Source Heat Pump."

Why landlords should invest in 'green' rental properties

There are numerous benefits and incentives for landlords to invest in green housing, and now couldn't be a better time.

More appealing buy-to-lets

Eco-friendly properties will help landlords make their buy-to-lets more appealing and add value to their properties.

Caters for the target tenant

Landlords who invest more in their properties to offer a place that caters to their target tenant see the most market success. Tenants are beginning to expect more from their rental properties, and as environmental issues prevail on people's minds, green housing is appealing to a wide range of tenants.

Eco-properties as an energy-efficient selling point

Landlords can now utilize eco-properties for their energy efficiency. As we all spend more time in our homes with coronavirus lockdowns, household bills go up. This will be particularly appealing for prospective tenants who are now working from home full-time.

Green mortgages as an added incentive

Lastly, green mortgages are gaining popularity. The UK population becoming increasingly eco-conscious has allowed ‘green mortgages’ to find their place in the mainstream market. The mortgages give borrowers special rates linked directly to the energy performance of their properties. This provides an added financial incentive for landlords and investors to focus on green credentials.

New leasehold reform: Will it make homeownership fairer?

- New leasehold reform will save millions of leaseholders tens of thousands of pounds

- What does the reform change?

- Will it make homeownership fairer?

What is the new leasehold reform?

New legislation that has been brought forward, will give leaseholders the right to extend their lease for 990 years at zero ground rent. The leasehold reform will save millions of leaseholders up to tens of thousands of pounds. The government described these measures as part of English property law's biggest reforms in 40 years.

Housing Secretary Robert Jenrick says: "Across the country, people are struggling to realise the dream of owning their own home but find the reality of being a leaseholder far too bureaucratic, burdensome and expensive.

"We want to reinforce the security that homeownership brings by changing forever the way we own homes and end some of the worst practices faced by homeowners."

What does the reform change?

The reform will give leaseholders the right to extend their lease by a maximum span of 990 years with zero ground rent. Previously, leaseholders of houses have only been able to extend their lease for 50 years at a time and had to pay ground rent.

Leaseholders have also been met with expensive charges to extend the lease. Some of these extra costs have now been abolished with the reform, such as the "marriage value". This required leaseholders to share information with the freeholder about potential profits from extending a lease.

A cap on ground rent, the cost paid when a leaseholder extends the lease or buys the freehold, will also be introduced. An online calculator will now make it easier for leaseholders to know how much it will cost to do either. This hopes to make the costs associated with a lease more transparent.

Will it make homeownership fairer?

While the proposed leasehold reform has much to support, many in the industry feel they need some more detailed information. There are concerns that the reform has created further uncertainty for leaseholders. Moreover, there is apprehension that the proposed actions could take years to become law.

However, for many in the property industry, there is a shared hope that the reform will make homeownership fairer and put an end to the ground rent scandal.

What is the ground rent scandal?

The ground rent scandal is one of the reasons why leasehold reform is so important. Objections to the unfair expenses on leasehold flats and homes sold with unclear clauses began some years ago. Some clauses involved freeholders increasing ground rent excessively. In some cases, leaseholders saw their rent double every ten years. The increased costs left some homeowners struggling to sell their property. As a result, properties with short-leases or high ground rents are often left vacant.

Mark Hayward, the chief policy advisor at Propertymark, discusses the organisation's research into the ground rent scandal:

"Our research' Leasehold: A Life Sentence' in 2018 found that 46 percent of leasehold house owners were unaware of the escalating ground rent when they purchased their property. Over one million households in the UK are sold through a leasehold, and this new legislation will go a long way to help thousands of homeowners caught in a leasehold trap."

Conclusion

Homeowners will see direct benefits from the government's leasehold reform. 4.5 million homeowners will save up to thousands to tens of thousands of pounds. Furthermore, the reform will allow leaseholders to buy a freehold for a lower price. Overall, homeownership costs will become cheaper, and property sales will be more straightforward.

Let's not forget about the benefits for properties with shorter leases. Properties with short-leases or high ground rents are sitting empty around the country as owners struggle to sell. Homebuyers will now become more open to purchasing properties with shorter leases leading to fewer stranded, vacant properties.

All in all, the leasehold reform is provides willingly received changes to many in the property industry. The only desires that remain are for details to be made explicitly clear and actions to be fulfilled promptly.

London Property Market 2021

- Londoners leave the capital

- Foreign investment to remain strong

- Tenant demand to increase

The development of the property market will principally rely on the UK's economic resurgence from the coronavirus. In 2021, the economy is forecast to grow by 5.3%, but the recovery still faces uncertainty.

The pandemic's ambiguity meant it was a challenging year for the property sector, and it's tough to predict how the market will prove in 2021. Despite the ongoing Brexit unpredictability, the outlook for 2021 is largely positive. Industry experts are optimistic that Brexit is not likely to have much of an impact on the housing market in the short term. This year, the London property market will see Londoners continue to leave the capital while investment from overseas remains strong. Tenant demand will begin to increase and, by the end of the year, the rate of rental decline will have slowed.

The London Exodus

The COVID crisis sparked a London exodus, with a sudden scramble to purchase homes on the outskirts of the capital. As the pandemic forced most of the nation to work from home, more and more people chose to leave London. As a result, commuter belts have widened around London and all major cities.

In 2021, the trend is set to continue with more Londoners realising the potential of working from a rural home or commuting once or twice a week. Estate agency Hamptons forecasts that the London exodus will continue for at least the first half of the new year but may slow down as house prices flatline.

Foreign Investment

Foreign investment in the capital is predicted to maintain strong levels in 2021.

Foreign investment from around the globe forms a significant share of London's property business. Despite the challenges London is facing, investors abroad have not forgotten the long-term appeal. Recent reports state London is the second-best place for property investment in Europe. The capital had climbed two spots from the previous year's 'Emerging Trends in Real Estate' report (PricewaterhouseCoopers and the Urban Land Institute).

Local and foreign investors alike have been closing on prime property during the stamp duty holiday. Many are raring to close deals before the additional 2% tax returns for international buyers in April. However, many industry experts are confident that the charge will not deter foreign investment.

Renters and Landlords in the Capital

In 2021, the tenancy market may improve in London.

Renters in London were at a shortage in 2020 as tenants encountered financial challenges. Job uncertainty, furlough wage reductions, and redundancies had their effect on the London rented sector. Supply increased substantially in the capital, and some landlords had to accept lower rent to avoid void periods. Central London saw rent fall by 20%, according to statistics from estate agents Chestertons. Other prime London locations saw 15% decreases, and rental prices in Greater London lessened by 4%.

This year, the number of properties available to rent will likely decline. Once restrictions begin to lift, demand is likely to pick up, and the rate of rental decline will lag. If this year sees the economy recover as anticipated, rent will likely resume growth over the course of 2022.

A Guide on How to Become a Property Surveyor - The Qualifications, Salary and Skill Requirements

To give you an insight into the profession of a property surveyor, Octagon Capital looks at everything you need to know about becoming a property surveyor.

Key Points

- A property surveyor is a qualified professional who is brought into to assess the structural integrity of a building - maybe for purchase, sale or valuation purposes

- A graduate surveyor can earn between £22,000 to £26,000

What does a property surveyor do?

A property surveyor is a qualified professional that assesses the structural integrity and quality of a building - including homes, offices, retail stores, garages and more.

A surveyor is typically brought in to assess the quality and value of a property, which the owner may wish to put on the market or better understand the value of their asset. The role of the surveyor is key to highlight any risks for potential owners or buyers and their involvement is usually a requirement to complete on any kind of property purchase, mortgage deal or even a bridging loan.

Property surveyors work in housing (residential) or for offices and retailers (commercial).

There are several titles under the role of a property surveyor including building surveyor, land surveyor or chartered surveyor.

What are the key responsibilities of a property surveyor?

Property surveyors essentially contribute towards the smooth running of the property market. Their main responsibilities typically involve:

- Analysing progress reports

- Dealing with planning applications

- Following health and safety regulations

- Reviewing project tenders

- Conducting risk assessment and cost control

- Advising subcontractors and clients

- Preparing scheme designs with costings and specifications

- Carrying out feasibility studies

A property surveyor checks the quality and integrity of a property or building and their role is key to proceed with a mortgage or property purchase.

What is the salary of a property surveyor?

Graduate surveyors can expect to earn between £22,000 to £26,000 and with a few years of experience, this can rise to the bracket of £28,000 to £50,000.

Senior level surveyors can expect to earn upwards of £70,000 and there is even potential to reach a six-figure salary at partner or director level.

Property surveyor salaries not only depend on experience, but also location. Surveyors based in central London can expect higher salaries than those operating outside of the capital.

According to the RICS Macdonald & Company Rewards & Attitudes Survey conducted in 2019, the average salary of a property surveyor was £48,000. Chartered surveyors were found to earn around 38% than those non-chartered.

What qualifications do you need to become a property surveyor?

To become a property surveyor, there are typical requirements of a degree or professional qualification approved by the Royal Institute of Chartered Surveyors (RICS) in one of the following subjects:

- Civil engineering

- Building engineering

- Property

- Construction

- Surveying

Studying a RICS-accredited degree or qualification will give you the relevant training to become a chartered surveyor.

This can be completed at undergraduate level in 3 years - see RICS Courses for more information.

Courses can also be completed online here at https://academy.rics.org/

Another option is getting a postgraduate qualification with a RICS-accredited Masters degree which will lead towards chartered training. Some employers may even support students taking this course with funding.

Additionally, there are apprenticeship opportunities for those who do not wish to go down the formal further or higher education route - https://www.rics.org/uk/surveying-profession/what-is-surveying/surveying-apprenticeships/

What skills do you need to become a property surveyor?

If the idea of working as a property surveyor interests you, it is important to check whether you have the right skills required for the job role before going further. Property surveyors need to have:

- A driving license (to visit different sites)

- A local and practical mind

- Strong oral and written communication skills

- The ability to build strong relationships with clients and peers

- Knowledge and interest in buildings and construction

- Negotiation, presentation and report writing skills

- Commercial awareness

A property surveyor should have good communication skills and have a good knowledge of buildings and property.

Can you work as a freelancer or with a firm?

Yes, It is possible to freelance as a property surveyor, but the decision to do so usually comes after several years of experience and building up a reputable client base. Going freelance suits those who may wish to specialise in one particular area, such as building defects or sustainability.

Typical career prospects for a property surveyor who is not freelance include working within the public sector or organisations. In large organisations, there are often formal channels of promotion and greater responsibility.

Either way, the environment you work in will certainly vary from day-to-day. For instance, you could be working on a construction site one day, and then from home or in an office the next.

The governing bodies for surveyors in the UK

RICS - https://www.rics.org/uk/

The Ecclesiastical Architects & Surveyors Association (EASA) - https://www.easanet.co.uk/

Eco-Friendly 'Green Mortgages' To Become The Norm

- Green mortgages are a type of mortgage that offers favourable terms for those buying energy-efficient homes.

- These favourable terms can include cashback on green mortgages or lower interest rates.

- Those looking to qualify will usually need an EPC (Energy Performance Certificate) at A or B.

Recently, the UK population becoming increasingly eco-conscious has allowed 'green mortgages' to find their place in the mainstream market. They offer borrowers preferential rates directly linked to the energy performance of their properties. As a result, it gives home buyers and investors an extra impetus to look at newer, more eco-friendly properties to keep costs down.

What Are Green Mortgage Products?

The fact that many of us aren't aware of what these product options are is one of its most significant struggles. The sector offers better-rate mortgages for properties with eco-friendly energy performances. Therefore, in practice, if you are choosing to buy an energy-efficient property, your mortgage rates will be better!

Research from Intermediary Mortgage Lenders Association (IMLA)found that 43% of borrowers hadn't heard of Green Mortgages. More than a third of borrowers also wrongly believed green mortgages would cost more. The statistics show that around 77% of eco-aware lenders offer green products that are equal to or cheaper than a standard mortgage. Currently, only a relatively small number of lenders provide green mortgages, but the survey saw 29% planning to introduce such a product. A further 35% of agents also plan to advise buyers on green mortgages in future.

Why Are 'Green Mortgages' Becoming Popular?

As of yet, there are only a few lenders in the UK offering better-than-normal rates on eco-friendly properties. However, a growing trend for eco-friendly products across sectors has provided an added incentive for investors. When focussing on eco-trends, it is evident that this is a growing one, with more people becoming dedicated to doing their part against the devastating effects of climate change. This entices more buyers to steer towards eco-friendly products and properties. There are plenty of indicators that eco-friendly mortgage products will improve in number. Lenders and advisers alike are beginning to recognise the potential of green mortgages and advise buyers accordingly.

The effects of the Covid-19 lockdown may have spurred this by providing a glimpse of a world with reduced carbon emissions. As a result, the growth of green finance is sure to continue to accelerate. The IMLA also reported that 74% of lenders think green mortgages will be more significant in the finance sector in future, and increased interest has already been noted since the pandemic outbreak.

The reasons for this growth in popularity are vast and varied, but most regard either the environmental or financial factors. Some buyers wish to improve their carbon footprint by living in a more environmentally friendly property. However, cost savings entice more than half (53%) of consumers.

What Are the Eligibility Criteria for a Green Mortgage?

While each lender will have their own set of eligibility criteria for green mortgages, some common requirements include:

- Need to meet a certain level of energy efficiency

- Will need an EPC (Energy Performance Certificate) at A or B

- The property is a new build

Your eligibility for a green mortgage, as with any other type of mortgage, will be dependent upon a range of different factors, and can be greatly influenced by your current circumstances and financial situation. For example, if you have an adverse credit history, or an unstable income the lender may be more hesitant to approve the mortgage.

If you're unsure about your eligibility for a green mortgage, or a mortgage altogether, it might help to discuss your options with a mortgage broker. Mortgage brokers can help advise you on the options that'll work best for you, basing this off of your current circumstances and other details you provide them with.

What Issues Does The Green Market Face?

Eco-friendly properties face the problem of cost when going green. 27% of property owners agree that affordability is an issue for them. Many investors do not find it worth the price of improving energy efficiency. To combat this, the Government has created The Green Homes Grant which could act as a great incentive. Green mortgages work as a great alternative option for customers, but there are considerable barriers which still stand in the way towards growing the green finance sector.

The Government has committed to making Britain carbon-neutral by 2050 and, to do so, the existing housing stock will have to make changes to create more energy-efficient homes.

Will First-Time Buyers Set To Receive Low-Deposit Mortgage Deals?

Prime Minister Boris Johson has pledged 95% mortgages for two million first-time buyers. The Government unveiled plans for 'generation buy' at a virtual Conservative Party conference. The Prime Minister said: "We need now to take forward one of the key proposals of our manifesto of 2019: giving young, first-time buyers the chance to take out a long-term, fixed-rate mortgage of up to 95 percent of the value of the home — vastly reducing the size of the deposit."

How Will It Work?

The Government has revealed intentions to make 95% mortgages more extensively available for first-time buyers, but it is still uncertain how the proposals would work. The Prime Minister discussed the issue facing two million prospective first-time buyers who could afford to pay mortgage repayments but are having difficulty getting approved for a home loan. He believes the Government has a role to play in unlocking low-deposit loans to generate 'the biggest expansion of homeownership since the 1980s'.

The proposal is also reminiscent of government-backed low-deposit mortgage schemes introduced after the 2008 crash. A similar program was launched as part of the Help to Buy plan during the 2008 recession because of banks withdrawing their high loan-to-value mortgage products. Previously, there were 100 percent loans on offer for buyers.

The Government has not released any details on how the scheme might work. According to a report by The Telegraph, one prospective design is for banks to get rid of the rigorous stress tests that were introduced after the financial crash. Rather than the stress tests, the Government could impose a guarantee for these higher loans. This would remove the risk placed on lenders, allowing them to offer low-deposit loans without worry. The tests are designed to assess whether a buyer will keep up mortgage repayments should interest rates rise from their current rate of 0.1%.

How Could The Scheme Help First-Time Buyers?

Boris Johnson said that the scheme will help up to two million people who can afford mortgage repayments but can't currently find home loans. While high loan-to-value mortgages were widely offered at the begging of this year, the COVID lockdown caused many lenders to withdraw their products. Banks and building societies were inundated with a backlog of inquiries when the housing market reopened, and some became overwhelmed with the demand. The decision to remove the low-deposit mortgages may have been due to economic uncertainty - as the economy walks a tightrope many lenders wish to distance themselves from providing riskier loans.

In theory, first-time buyers will be able to buy with a five percent deposit once again under the new proposals. The result hopes to "turn Generation Rent into Generation Buy." However, buyers should still be aware of the possible risks that remain. When you buy a property with a low deposit, there is often a greater risk of negative equity if the property market doesn't rise but instead declines.

Home Truth: Lockdown Caused 21% Reduction in Planning Permission Applications

Lockdown Caused 21% Reduction in Planning Permission Applications

- Same time period in 2019 saw only a 5% decrease from the year before

- North East and Yorkshire & Humber saw the largest drop in planning permission applications during lockdown (27%)

- 87% of planning permission applications were approved in 2020

New research from bridging loans broker Octagon Capital reveals that lockdown had a significant impact on the number of Brits applying for planning permission, with numbers from April, May and June 2020 down 21% on the same time period the year previously.

The research, which analysed gov.uk data, found that the decrease in planning permission applications during lockdown is far more significant than in 2019, where there was only a 5% decrease in applications during the second quarter of the year. In 2018, there was only a 3% decrease.

The good news for those who have applied for planning permission during lockdown is that the likelihood of having an application approved doesn’t seem to have been affected. 87% of planning permission applications in 2020 have been approved, marginally lower than the two years beforehand (88%).

Regionally, the North East and Yorkshire & Humber both saw a 27% drop in the percentage of planning permission applications between the second quarter of 2020 and the same period of 2019, the largest in the country. On the other hand, the South West has seen a 17% decrease, which is the lowest.

See also:

Rise in mortgage approvals 'highest in 13 years'

Dan Kettle: 'Bridging volumes halve in Q2'

Sunak approves stamp duty change

Percentage difference in the number of planning permission applications between Q2 2019 and Q2 2020

|

Region |

Percentage Difference in Planning Permission Applications, Q2 2019 – Q2 2020 |

|

North East |

-27% |

|

Yorkshire & Humber |

-27% |

|

North West |

-23% |

|

East of England |

-22% |

|

South East |

-22% |

|

West Midlands |

-20% |

|

East Midlands |

-19% |

|

London |

-19% |

|

South West |

-17% |

Planning permission applications in the North East were the most likely to be approved during lockdown, with a 94% approval rating. Meanwhile, only 79% of applications from London were approved, the lowest rate nationwide.

Dan Kettle, Commercial Director at Octagon Capital, commented: “COVID-19 has impacted every aspect of our lives, but the 21% drop in the number of planning permission applications during lockdown is particularly telling when it comes to looking at how Brits are prioritising their finances during a difficult time.

“There are positives from this research for those who still want to expand, for example to build a home office to help them work from home. The approval rate for planning permission applications has remained high and at the similar level to 2019. The best way to ensure your application is approved is to do your research beforehand and bringing in an architect to ensure your plans are up to scratch.”

To find out more about Octagon Capital and how planning permission has been impacted by lockdown, visit: https://octagoncapital.co.uk/guides/lockdown-caused-21-reduction-in-planning-permission-applications/

How Does The Stamp Duty Holiday Work?

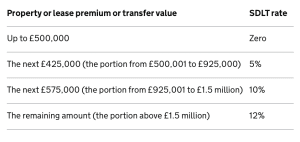

What is stamp duty?

Stamp Duty Land Tax is a tax on the purchase of properties. Stamp duty is only paid in England and Northern Ireland. The devolved administrations of Scotland and Wales have alternative property taxes (Land and Buildings Transaction Tax and Land Transaction Tax, respectively). How much tax you owe the government depends on the property value, and where you are in the UK. The temporary changes to stamp duty currently in place only apply in England and Northern Ireland.

What has changed?

The threshold for stamp duty has been increased temporarily to £500,000 for properties in England and Northern Ireland. This applies to anyone purchasing their primary residence. If your property costs up to £500,000, you will not pay any stamp duty. Higher-value properties will only be taxed on their cost above that amount, potentially saving buyers tens of thousands of pounds.

Before the new policy was introduced in July, buyers paid stamp duty in England and Northern Ireland on land or property with a value of £125,000 or more. The first-time buyer discount allowed those entering the property market to pay no stamp duty up to £300,000 but is now replaced by the stamp duty holiday.

Landlords and second-home buyers will also see a tax cut but will still be eligible to pay the extra 3% stamp duty that has always been allocated to them.

Who benefits?

The stamp duty holiday was put in place to help buyers in a time when many are facing financial hardships as a result of the coronavirus. Chancellor Rishi Sunak has suggested that with the new policy, the average saved on a stamp duty bill is £4,500. Moreover, nearly nine out of ten home buyers this year will pay no stamp duty at all.

While it is aimed at buyers, homeowners are also benefiting and pocketing some extra money. With the policy in place, homeowners have more of an incentive to keep their asking price high, knowing that the buyer is saving on stamp duty. This is particularly significant with the sale of high-value properties which can run a stamp duty bill of tens of thousands of pounds. The stamp duty savings will likely end up being shared, with both buyers and sellers managing to save.

How have house prices been affected?

The Stamp Duty holiday intended to boost the property market after it took a hit during lockdown when house prices fell consecutively for four months. The stamp duty tax holiday has already taken effect by increasing house prices. In August, prices accelerated the most in one month for more than 16 years, according to Nationwide. They describe the sudden recovery as 'unexpectedly rapid'.

On the other hand, fears have begun to muster that the tax break will encourage those who were intending to buy next year to advance their plans. This could create a vast drop in demand when the tax break ends.

When does the stamp duty holiday end?

The stamp duty holiday in England and Northern Ireland is nine-months long. It began in July 2020 and will end in March 2021. According to HMRC figures, the government usually raises around £12 billion annually from stamp duty land tax. Though, the tax holiday is set to cost the Treasury an estimated £3.8 billion.

Storage Wars: UK Cities Paying Nearly Double for Self-Storage

- Londoners pay 107% more per week than average for a 50 sq. ft. storage unit

- Camden is the most expensive place to rent storage space in the UK (up to £101.63 p/w)

- Local 100 sq. ft. units cost 8% of a Londoners average wage, 7% of Swansea and 6% of Manchester, Liverpool and Newcastle

New research from bridging loans broker Octagon Capital reveals the cities in the UK getting the worst deals on self-storage units, with Londoners paying significantly over the odds at a rate 107% higher than the national average.

Looking at the average cost of a 50 sq. ft. unit in locations around the country (ideal for storing the contents of a one bedroom flat), London is the most expensive, with customers likely to spend an average of £1,797 per year.

Considerably higher than second place Swansea, which has an average of £1,006 per year for the same sized unit. Exeter residents are getting the best deal in the country, paying 31% less than the nationwide average (£598 p/y).

| Average annual cost for 50 sq. ft. unit (£) | Percentage Difference from Nationwide Average | |

| London | 1,797 | 107% |

| Swansea | 1,006 | 16% |

| Liverpool | 958 | 10% |

| Edinburgh | 892 | 3% |

| Manchester | 882 | 2% |

| Bristol | 833 | -4% |

| Newcastle | 803 | -7% |

| Cardiff | 765 | -12% |

| Birmingham | 745 | -14% |

| Glasgow | 700 | -19% |

| Portsmouth | 650 | -25% |

| Southampton | 650 | -25% |

| Exeter | 568 | -31% |

| Nationwide Average | 868 |

This trend continues when looking at 75 and 100 sq. ft. sized units, ideal for a two-bed flat or house, with London topping both tables and costs averaging 110% and 100% more than the average respectively. Liverpool similarly finds itself at the top end of the table for each unit size analysed, paying 12% more than average for 75 sq. ft. (£1,238 p/y) and 17% more for 100 sq. ft. (£1,674 p/y).

Camden in London has the highest individual costs per year for 75 sq. ft. and 100 sq. ft. units (£3,542 and £5,285 p/y respectively), while also placing second for 50 sq. ft. (£2,909 p/y) behind Kennington (£3,024 p/y).

Even when taking into account the average weekly wage in areas around the country, Londoners are still paying over the odds. For example, a 100 sq. ft. storage unit costs 8% of the average weekly wage of a Londoner, compared to just 3% of Portsmouth residents at the other end of the table. On average, 5% of the weekly wage would be spent on a storage unit in London of this size.

Dan Kettle of Octagon Capital, commented: “There are many factors that affect pricing in cities around the UK, but the large difference in costs between London and the rest of the UK is still significant when you take into account the proportion of the average wage that relates to.

“The best way to get a good deal on self-storage is to ensure you select the right sized unit so you’re not overpaying on space, and always shop around. There may be a better deal with a different company and don’t forget to try and negotiate costs.

“At Octagon Capital we provide bridging loans to assist those looking to embark on a project such as a move, renovation or refurbishment where self-storage is often needed.”

References

Data consists to quotes for various sized self-storage units by Big Yellow, Safestore, Shurgard and Lok’nStore on w.c. 29th July 2020, with annual costs reflecting the weekly cost multiplied by 52

Average wage data via Centre for Cities: https://www.centreforcities.org/data-tool/#graph=map&city=show-all&indicator=average-weekly-workplace-earnings\\single\\2019

Bridging Loans lends out nearly £4bn in 2018

In the last 12 months, it has been reported by the Association of Shirt Term Lending (ASTL) that the bridging loans industry has collectively lent a whopping £3.98bn.

This figure is 21% over the last year. However, the second has seen a slight contraction in the third quarter of 2018 compared the three months preceding that. The value of the loans written and applicants were down 0.6% and 3.3% respectively.

When you compare this to the same quarter of last years, the value of loans written in the quarter increased by 12.6%. Speaking in annual terms, applications were also up by 8.9% compared to the year which ended in September of 2017 - this totals up to £20.5bn.

It was noted by the ASTL that although applications did tend to be unreliable indicators and were dependent on how many lenders were offered the same deals, it did actually highlight how large the sector had become.

Loan books up

If you total up the loan book value, it appears to have continued to climb with a rise of 2.1% compared to Q2 and an increase of 16.6% at the same point, but last year.

The CEO of ASTL, Benson Hersch, said Figures for Q3 2018 show an ongoing year-on-year upward trend. Our members continue to provide flexible and useful services to customers who require finance for a whole range of purposes. Despite current political and economic uncertainties, lenders are very much doing business as usual.”

What is a bridging loan?

Bridging Loans are short-term loans which are designed to ‘bridge’ the gap found between a debt coming due and the main line of credit becoming available. In addition, they can also be used to simply act as a more general short-term loan in certain, pressing circumstances.

Bridging loans may be invaluable in helping an individual to make a property purchase that they would other not be able to be possible. For example, if someone cannot get a mortgage in place and they need to purchase the property now, a bridging loan would help to facilitate this.

The loans are essentially designed to help people complete a purchase of a property before they sell their existing home by offering the people access in the short-term to money at a high rate of interest.

Some people have started viewing bridging loans as a simple alternative to mainstream lending. While a bridging loan may sound like a tempting option in this capacity, before you take one out you should think about your strategy. If you are treating bridging loans in a traditional way, this might be, for example, getting a mainstream mortgage or a buy to let mortgage, or selling the property altogether.

Who are bridging loans aimed at?

Typically, bridging loans London and UK are aimed at landlords and amateur property developers. This includes those who are purchasing at auction where a mortgage is needed quickly.

They are often aimed at wealthy or asset-rich borrowers who want a straightforward lending method for residential properties.

Who are Octagon Capital?

Here at Octagon Capital, we are a licensed broker which aims to help you to compare bridging loans in the UK. These loans can range from £50,000 to £25 million.

In terms of your application, we have partnered with SPF Short Term Finance, a team of bridging loan brokers, in order to process any application you submit. You can apply online and an advisor from the SPF Short Term Finance team will be directly in touch with you shortly about the status of your application. If you please, you can call us for a quote today on 0333 414 1491. We are open Monday-Friday from 9am to 6pm.