Property crowdfunding is somewhat new on the property scene and could become another popular way of providing finance for properties in much the same way that bridging finance lenders have come to dominate the sector. For example, in a 2016 report by think tank Nesta, it was reported that property crowdfunding via p2p loans had raised an astonishing £609 million, with a further £87 million through other equity crowdfunding platforms. So, how exactly does this kind of investment work? We explain everything you need to know.

Property crowdfunding

Property crowdfunding essentially brings together technology and platform based peer to peer lending. Companies who have created crowdfunding platforms for property investment in the UK allow investors to pool money together. This then allows everyone to get a share of the property which can then be bought. These shares are calculated based on how much each individual investors contributes to the investment pot. That essentially creates what is known as a special purpose vehicle (SPV) which is advantageous, as it means that it can have as many shareholders as it wants, or as many as are willing to help fund it.

What happens next?

The next stage of this crowdfunding model is that the building bought through this platform is then rented out. Each person with a share also gains a share of the rent.

Any fluctuations in the house valuation can also determine the value of your shares as well. That means that being an investor under this model can be particularly lucrative, as not only can you benefit from the rent share, but also if the value of the property rises over the time. That means you also get a share in the capital growth too.

Furthermore, getting involved in property crowdfunding is relatively stress-free in terms of your commitment and overall day-to-day involvement. For example, with some property crowdfunding models, you can invest as little as £30 to £50, without having to worry about all the aspects involved in the typical buy-to-let model, such as having to deal with tenants, property management and other issues.

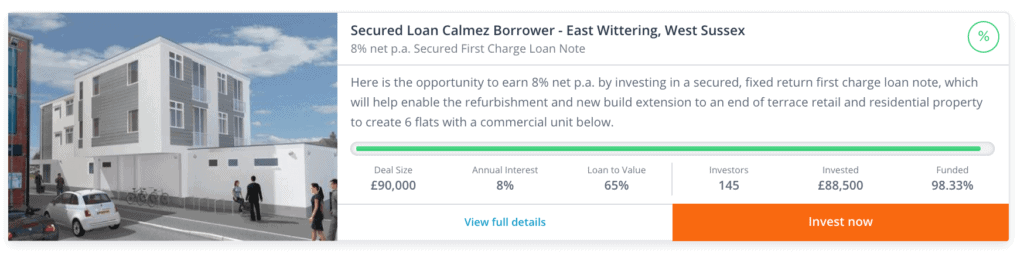

Here is an example of property crowdfunding below from Property Moose:

How can I get into property crowdfunding?

There are various routes to property crowdfunding for those who are interested. For example, some people decide to get involved through bonds, loans or equity.

Furthermore, people are not limited in terms of the kind of property they can invest money in. For example, it is possible to invest in just commercial or residential property. Or if you so wish, you also have the option to invest in both at the same time.

Nevertheless, if you do decide to invest in both commercial and residential property, it is worth remembering that both have different elements of risk involved if you decide to contribute to either.

There is also the option to fund building projects from the construction phase all the way to sale. You could also get into bridging loans over the short term, as a way of then accessing higher returns over a longer period of time.

Advantages of property crowdfunding

As previously stated there are a number of different advantages to crowdfunding. For example:

- You have much more choice and therefore greater freedom when it comes to how you invest

- There is less commitment involved compared to other types of property development that you could invest in such as buy-to-lets

- It allows people to build a property portfolio and diversify quickly at a much faster rate than other types of investment

- It allows people to engage in buying multiple properties (from residential to commercial) without the need for having a huge amount of capital up front, again, this is not always possible with other kinds of investment

- Each SPV owns a single property, and therefore it is completely separate from the platform itself

Disadvantages of property crowdfunding

- Like any other kinds of investment products, there are risks involved and the property crowdfunding market varies from project to project. Therefore, you should always make sure that you have done plenty of research before deciding which platform you want to invest in, or a number of platforms

- Remember that there are also fees involved which can end up being quite costly. For example, many property crowdfunding models will charge you an initial finder’s fee. The exact amount that you will pay will depend on the platform that you opt for, but you can expect to pay anything between 5 and 10 per cent. These are costs that you should be factoring in when you decide whether or not property crowdfunding is the right investment for you

- Furthermore, some will also require you to pay on top of an initial finder’s fee a management fee on the yield too. You can expect to pay between 10 and 25 per cent for this.

- There may also be a capital gains fee of another 15 per cent, but this is not necessarily the case between all the platforms.