What factors do bridging loan lenders consider when approving a loan?

If you are considering making a bridging loan application, (typically because you are looking for funds to help bridge the gap between selling and the completion of an existing property that you have, and having the money in order to facilitate the brand new home) then it is worth making sure you are completely clued up as to the lending criteria bridging loan lenders will be assessing you on when deciding to approve or decline your application.

As one of the leading bridge finance brokers in the country, we have decided to put together a clear, concise guide to this criteria, in order for you to make the best application possible and therefore improve your chances of being accepted for this type of line.

Do you have an exit strategy?

When you make an application for a bridging loan, you will have to provide the loan provider with an exit strategy, which will be assessed. What we mean by exit strategy is when and how you will be able to make prompt repayments on the loan that may potentially be granted to you, this will also be dependent on the type of bridging loan that you have applied for too. For example, if you are looking to get access to an open bridging loan, then it will not be a requirement for you to provide an exact repayment date to the lender, however, do keep in mind that you will need to repay this loan back usually within a three year time period, and you must assure the lender that it is financially viable for you to do so. On the other hand, if you apply for a closed bridging loan, you will need to provide an exact repayment date for the lender, this will typically be when you have managed to sell your property and it has reached completion.

The type of property

Another factor that loan providers will be assessing when deciding to approve or decline you for a bridging loan is the kind of property you are intending to use the loan for. Whilst most property types (whether it be flats, houses, shops, office, parking spaces, hotels, guesthouses, bars) can all be taken into consideration for a bridging loan, you may find that it is the case that the interest rate and charges are better for those which are secured against residential property. The type of information that the lender will also require on a building you are intending to buy, or if you are using the loan for refinancing purposes include:

- The tenure of the property - whether it is freehold or leasehold

- The purchase price of the property

- The value of the property

- The cost of works (if you are intending to buy and then refurbish the property in or to sell on as an investment)

- The estimated value of the house once these refurbishment works have been carried out

- The proposed works that are to be carried out

Age of the applicant

As is the case with almost every type of loan on the market, the age of the applicant will be taken into account, and this will be a minimum applicant age of 18 years old and could be higher than this dependent on the lender. In some cases, there can also be a maximum age limit for one to be able to apply for a bridging loan.

Employment status

Another factor that will be considered by a bridging loan lender will be your employment status. Generally speaking, bridging loan applicants tend to be property developers, so a lender may be assessing their previous projects in order to determine how likely it is that they would be able to make prompt repayments at the end of the term for the bridging loan. If you aren't a property developer and are applying for a bridging loan for the very first time, then the loan provider will be wanting to make sure that you have sufficient funds and a stable enough income in order to pay the loan back when the time comes. For example, if you are constantly applying for payday loans to maintain your finances, you are far less likely to receive an approval for your bridging loan application.

Sufficient collateral

One of the main advantages of bridging loans is the fact that lenders do not necessarily always take into consideration your credit history (however, this is not necessarily the case with all bridging loan lenders, so you should definitely check with the lender in question prior to making an application if you feel that your credit score may be an issue).

This can be a huge plus when so many other types of loans available on the market tend to focus very heavily on whether or not your credit history is good or bad, and can often be the deciding factor as to if your loan application is approved or declined.

On the other hand, what most bridging loan lenders do require you to have is to have sufficient collateral in order to make sure that you will be able to make repayments at the end of the term. The collateral that you will have will be usually the property assets that you have, and these can be secured against different property types including commercial, residential and in certain cases land and building plots.

How does mortgage refinancing work?

When deciding to take out a bridging loan or not, it can be common for property developers to decide as a strategy to refinance their bridging loans once they have reached the end of the loan term. But what exactly does this mean when it comes to mortgage refinancing? We explain in further detail everything you need to know about this strategy.

Mortgage refinancing explained

In the simplest of terms, refinancing your mortgage is when a borrower who has taken out an old loan (this may be a mortgage or a bridging loan) to then exchange this for a brand new mortgage term, interest rate as well as also potentially a new mortgage term too. Some may decide to get a new mortgage with their existing lender or decide to refinance their mortgage with a new lender entirely.

You can also refinance bridging loans to help with your mortgage. A property developer may decide to opt for a second charge bridging loan in order to secure it against a property already has a mortgage outstanding. This is an option for those who are perhaps interested in raising funds in order to help carry out a renovation project (for example, to build an extension, create a loft conversion or other property improvement projects). This is because your main mortgage isn't being repaid, and you do not need to worry about early repayment charges that could be incurred due to the second charge bridging loan take out which is enabling you to raise the required funds.

How do I find the best mortgage refinancing deals?

If you are interested in the possibility of mortgage refinancing, then it is worth making sure that you are fully aware of:

- The percentage value of the home that you want to borrow against (the LTV ratio)

- What the current estimated value of your property is

- The annual income that you or anyone else who will be named on the new mortgage will be

You should also figure out what type of mortgage you would like to compare when it comes to mortgage refinancing. For example, consider the following:

- Tracker mortgages: this type of mortgage means that the mortgage rate that you pay is set a percentage above the base rate that has been created by the Bank of England (or your lender's standard variable rate). What this means for you is that if interest rates increase or decrease, the same will go for your mortgage repayments too

- Offset mortgages: that means your savings account and mortgage are combined together. In this scenario, that means the money which is in your savings account is counted as an overpayment (on a temporary basis) for your mortgage. This has the potential to save you a considerable amount of money over time when it comes to interest paid.

- Fixed rate mortgages: with this kind of mortgage, the interest rate is fixed for a period of time. In the majority of cases, this will be for a period of between two and five years in total. This can be a great option for you if you want to have the comfort of knowing exactly what your repayments will be costing you each month, without changing as a result of interest rates going up or down.

Is refinancing the right option for you?

It is worth noting that making the decision of mortgage refinancing is not the best decision for all homeowners. Some may consider mortgage refinancing to:

- To cut down on costs: some homeowners may choose to refinance their mortgage in order to benefit from lower interest rates overall or lower monthly repayments. It is estimated that almost half of all borrowers in the UK are in fact paying more than they need to on their mortgage

- Raising money: it can help to release equity in your home which can be particularly usefully if you are looking to consolidate existing debts or alternative release money for home improvements.

Who can consider mortgage refinancing?

Providing that you already have an existing mortgage, and meet the criteria set by the mortgage lender, you can be eligible for remortgaging. It may be particularly pertinent to you to consider mortgage refinancing if you are coming to the end of a discounted deal you were receiving, or are coming to the end of a fixed rate period on a mortgage.

What is classed as a new-build?

Due to the lack of property available across the country, the UK government is currently heavily incentivising new build homes, as well stating that in the next five years it aims to build over one million more new build homes. But what exactly is meant by a new build, and what is classed as one? We take a further look so you can make a more informed decision as to whether or not purchasing a new-build property is the right step for you.

What is a new build home?

In the simplest terms, this is defined as a property that has been yet to be purchased (it can still be occupied during this time_ within the first two years of being constructed, refurbished or converted. The new-build definition also extends to properties that have been bought off plan.

What are the benefits of new build homes?

There are a number of different potential benefits when it comes to deciding to purchase a new-build home. Here are some of the main reasons:

- The flexibility you have: as it is a new-build you do not have to worry when it comes to buying the process of being part of a chain, which can take a considerable amount of time and can also be quite stressful. It also means you have the flexibility to move at your own pace when it comes to sorting out the sale, and you have the flexibility when it comes to moving in, as you do not need to worry about waiting on buyers involved in an upward chain

- It comes with cover: it is possible that it is registered with the National House Building Council (NHBC) which will mean that you will be provided with a 10-year warranty and protection scheme too, which can help to provide you with peace of mind. There are also other companies that can provide insurance and warranties for new build homes, such as BLP

- Low maintenance: one of the best things about new-build homes is the fact you do not have to worry or get stressed out about maintenance, repairs or decorating when you first move in. In fact, it could mean that this kind of work will actually take place a few years down the line.

- Security: as a result of the high building standards now in place for all new-build homes, you can be safe in the knowledge that the property is safe. For example, most new-builds come with locks on doors and windows, fire safety, security lighting and in some places entry phones

- Getting in early: a number of housing developers and builders provide properties off plan, which means you have the potential to reserve your dream home prior to it being built. Furthermore, you could also end up potentially benefit from equity growth before you've even moved into the property if you manage to buy off plan in a location where house prices are on the rise.

- Bills are less expensive: another positive of new build properties relates to the reason that new builds are usually built and fitted with the very latest energy efficient appliances. That means then for you as a homeowner, they will most likely be cheaper to run than older properties, and they tend to be triple glazed or well insulated.

Schemes for new build homes

As well as potentially taking out bridging loans, there are support and schemes available for buyers who are interested in purchasing a new-build property.

Help to Buy

There are two parts to the Help to Buy Scheme. This is an initiative that enables first-time buyers and existing homeowners in England to buy a new home or an older property. There are also schemes that work in a similar way in Wales, Scotland and Northern Ireland.

It is worth noting there are two parts to the Help to Buy scheme:

- The equity loan: this can only be taken out for new-build homes only, and requires the buyer to have a deposit minimum of 5 per cent, with the government then providing a loan equal to 20 per cent of the value of the property.

- The mortgage guarantee: the second part of the Help to Buy scheme is where the government provides lenders with the opportunity to buy themselves a guarantee on mortgages (available for both new-build properties and older, resale homes too). That allows mortgage providers to then provide a greater number of high loan-to-value mortgages to borrowers as a result of this kind of insurance.

Starter Homes

Another government scheme pertains to the Starter Homes initiative. This is a pledge by the government to build thousands of homes at a discount to first-time home buyers who are between the ages of 23 and 40. However, at this moment in time, there have been no properties been built.

Shared ownership scheme

With this scheme, buyers who fit the eligibility criteria are able to purchase a percentage of a property (anywhere from 25 per cent to 75 per cent in total) of a new -build house from a local housing association. Over the course of time, they then pay rent that relates to the percentage of the property you do not own. Eventually, you will end up owning all of the property.

Increasingly, developers and house builders are offering their own incentives to buyers. These may include any of the following:

- Paid deposit

- Part-exchange deals, where your existing home is bought from you by the developer and then sold on

- Assisted sales, i.e. helping you to sell your existing property

- Free fixtures or fittings

- Paid Stamp Duty Land Tax

- Cashback

What does a conveyancer do?

Are you not entirely sure as to what a conveyancer is and what role they play exactly? We've broken it into steps to make it easier to understand and so you know exactly why you are paying them.

The role of the conveyancer

If you have just accepted an offer on a brand new property, the first step will usually be to ask for the help of a conveyancer in order to help you deal with the purchase. In the majority of cases, this will be a solicitor but you can also choose a property lawyer or a licensed conveyancer. Whichever you choose, you should always ensure they are regulated by either the Council for Licensed Conveyancers or the Solicitors Regulation Authority.

Opening the purchase file

The first thing a conveyancer does is open a purchase file and sends a letter to you requesting information from you such as your basic details, details of your estate agents, if you need a mortgage to purchase the property and if you do, where the deposit is coming from (perhaps through a bridging loan) and who is the lender. You might at this point also be provided on a fixed fee estimate based on the information given. However, it is worth noting that this price could be subject to change if the legal work becomes more complex further down the line.

Requesting a fee for searches

On average, you should be budgeting around £300 for Local Authority searches to be carried out by your solicitor. Local Authority searches help to detect any potential problems, like compulsory purchase orders or any outstanding enforcement notices for the property which can sometimes take a considerable amount of time to be processed.

Contacting the estate agent

Your conveyancer will be contacting the estate agents through which the property is marketed to get a memorandum of sale, otherwise known as a notification of sale. This information provides the solicitor's details for both parties involved. The next step for your solicitors is to contact the sellers in order to inform them that they will be acting on your behalf to purchase the property.

Receiving the seller's solicitors paperwork

Once the draft contract has been written by the seller's solicitor it is sent to your conveyancer alongside a copy of the 'Deeds' (also known as the tile). These will usually be electronically recorded and available online through the Land Registry, providing that the home has been sold once since 1990.

Your conveyancer will also be sent what is known as 'protocol documents' :

- A Fittings and Contents form: starting what will be removed or left in the building

- A Leasehold Information Form: if the property is a leasehold (a flat or an apartment are the most common types_ then it will set out things such as contact details for the management company and rent payable

- A Seller's Property Information Form: this is any information that the seller must tell the buyer. This may include things such as when the boiler was last serviced, or if there are any neighbour disputes.

Carrying out checks

One of the most important tasks your conveyancer will carry out on your behalf is going through all of the paperwork in order to see if there are any problems or questions that should be raised with the seller's solicitor. For example, this could be to do with flood risks or a discrepancy on the Deeds. Things like this tend to be lengthy and complicated, taking a matter of weeks.

Exchange and completion

Once you have provided a deposit of 10% of the purchase price to your conveyancer, they will now arrange with you a date in which you can arrange to move into your new home which is known as completion. Before this is finalised, it has to be agreed with the seller's solicitor too, as well as any other parties along the chain. Once a date has been mutually agreed upon, the conveyancer then helps to sort out a date in which contracts can then be exchanged.

The exchange is the part where the purchase of the property now becomes legally binding, it will be up to the seller's to release their contract ready for exchange, at this point the conveyancer can help to organise the process of exchanging contracts. The deposit at this point is then paid to the seller through your conveyancer's account.

The final completion statement

One of the final stages of the property buying process, your conveyancer will now send you the final completion statement. it is at this point also that you must pay the outstanding balance due for the property.

This includes things such as disbursements (the charges a conveyancer pays to third parties such as management company fees or Stamp Duty on your behalf) as well as the cost of the legal work that has been undertaken, and the balance of the mortgage amount. It is worth remembering the funds in question must have cleared in your solicitor's account prior to completion taking place. If you have paid money in advance for things such as search to be carried out, these will be deducted from the balance at this point.

Registering change of ownership

The final stage involves the conveyancer organising the change of ownership, which must be lodged with the Land Registry. After completion, the signed Deed is sent to your conveyancer who will send this to the and-registry">Land Registry for this to be registered alongside the mortgage deed, usually electronically. However, if its the first registration (e.g. its a new build) then the application will have to be posted.

What landlords should look for in their letting agent

As a landlord, you have a number of responsibilities towards your tenants, such as ensuring that their deposit is safely secured, and you make sure that regular maintenance is carried out in the building. However, before you get to the stage of renting out the property of others, you also have other responsibilities: to yourself.

There are a number of questions you should be asking prior to settling on a letting, or, if you have an existing relationship with one, continuously reviewing the relationship you have with them on an annual or biannual basis, so that you can determine whether you want to remain with the agent, change to another firm, or take on the role yourself. But what exactly do you ask? Below, we've listed some important questions to get you started:

- What type of properties do you let, and what kind of tenant?

- Can I see the contract?

- Who is responsible for maintenance issues?

- How do you report?

- Do you have samples of your documentation?

Whether you are new to the buy-to-let sector, or are a seasoned landlord but are still unsure what to ask, as a bridging loans lender, we understand the importance of asking the right questions and we are here to help.

What type of properties do you let, and what kind of tenant?

The majority of agents tend to do most things, however, some specialise in particular areas of the property market, such as rural homes, student lettings, larger family properties, or letting to LHA tenants. If you know exactly who your target market is, then asking this question is of vital importance, as you want to choose a lettings agents who is experienced in your tenant market. You want a letting agent who knows the market inside and out and understands what is important to people renting in the area.

Can I see the contract?

It may seem like a glaringly obvious question that a landlord could ask a lettings agent, but you would be surprised just how many do not end up asking this or looking at all at the letting agency's contract as well as the terms and conditions. However, this can be a big mistake to make, as not all lettings agencies share the exact same letting agent contracts. Before deciding to go with a lettings agent, you must see the contract, and make sure that it clearly states the fees, as well as the roles and responsibility of the lettings agent themselves. For example, do they check and prepare the inventory on your behalf, and do they carry out the handover? These are vital questions that need to be asked as well as verified in a contract.

Who is responsible for maintenance issues?

Depending on whether or not the letting agent has been employed by you on a full management contract or not, if it is the case, then agreeing delegated responsibility would be beneficial. That means that should issues arise or disrepairs, the letting agent has to contact you prior to deciding to employ a contractor in order to go ahead with the work. This means you can keep an eye on outgoings, as well as potentially use your own contractor instead if you are uncomfortable with the amount they are charging when you know that you would be able to find someone who is cheaper.

How do you report?

The way in which a lettings agent reports to a landlord is incredibly important. This is especially the case for those who have a fully managed arrangement on their rental property, as they will be looking for an agent who is able to give them regular updates. Therefore, be clear from the very start with them on the level of reporting that you want, as well as getting them to state what they are willing to provide. For example, ask questions such as will they send you reports on a regular basis of the rent and charges? Will you be sent on the details via email?

Do you have samples of your documentation?

It is worth looking at exactly what they end up putting on their tenancy agreements, check out reports and their inventories. You should be making sure that the letting agents is putting as much detail on the prospective tenant as they possibly can. This is key, as it means that in the event that the tenant ends up defaulting at a later date, there will be a wealth of information available in order to retrieve the payment. If you discover that they barely track any of their tenant's information, you should consider this as an alarm bell, and avoid using them. It could end up costing you a considerable amount of money in the future (for example, the tenant moves out and the inventory was miscalculated).

What is property crowdfunding

Property crowdfunding is somewhat new on the property scene and could become another popular way of providing finance for properties in much the same way that bridging finance lenders have come to dominate the sector. For example, in a 2016 report by think tank Nesta, it was reported that property crowdfunding via p2p loans had raised an astonishing £609 million, with a further £87 million through other equity crowdfunding platforms. So, how exactly does this kind of investment work? We explain everything you need to know.

Property crowdfunding

Property crowdfunding essentially brings together technology and platform based peer to peer lending. Companies who have created crowdfunding platforms for property investment in the UK allow investors to pool money together. This then allows everyone to get a share of the property which can then be bought. These shares are calculated based on how much each individual investors contributes to the investment pot. That essentially creates what is known as a special purpose vehicle (SPV) which is advantageous, as it means that it can have as many shareholders as it wants, or as many as are willing to help fund it.

What happens next?

The next stage of this crowdfunding model is that the building bought through this platform is then rented out. Each person with a share also gains a share of the rent.

Any fluctuations in the house valuation can also determine the value of your shares as well. That means that being an investor under this model can be particularly lucrative, as not only can you benefit from the rent share, but also if the value of the property rises over the time. That means you also get a share in the capital growth too.

Furthermore, getting involved in property crowdfunding is relatively stress-free in terms of your commitment and overall day-to-day involvement. For example, with some property crowdfunding models, you can invest as little as £30 to £50, without having to worry about all the aspects involved in the typical buy-to-let model, such as having to deal with tenants, property management and other issues.

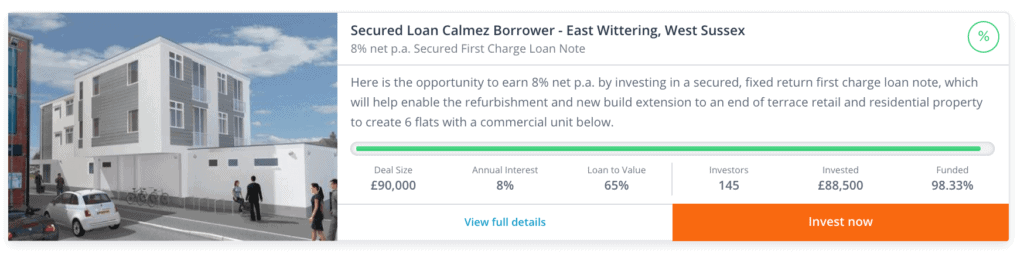

Here is an example of property crowdfunding below from Property Moose:

How can I get into property crowdfunding?

There are various routes to property crowdfunding for those who are interested. For example, some people decide to get involved through bonds, loans or equity.

Furthermore, people are not limited in terms of the kind of property they can invest money in. For example, it is possible to invest in just commercial or residential property. Or if you so wish, you also have the option to invest in both at the same time.

Nevertheless, if you do decide to invest in both commercial and residential property, it is worth remembering that both have different elements of risk involved if you decide to contribute to either.

There is also the option to fund building projects from the construction phase all the way to sale. You could also get into bridging loans over the short term, as a way of then accessing higher returns over a longer period of time.

Advantages of property crowdfunding

As previously stated there are a number of different advantages to crowdfunding. For example:

- You have much more choice and therefore greater freedom when it comes to how you invest

- There is less commitment involved compared to other types of property development that you could invest in such as buy-to-lets

- It allows people to build a property portfolio and diversify quickly at a much faster rate than other types of investment

- It allows people to engage in buying multiple properties (from residential to commercial) without the need for having a huge amount of capital up front, again, this is not always possible with other kinds of investment

- Each SPV owns a single property, and therefore it is completely separate from the platform itself

Disadvantages of property crowdfunding

- Like any other kinds of investment products, there are risks involved and the property crowdfunding market varies from project to project. Therefore, you should always make sure that you have done plenty of research before deciding which platform you want to invest in, or a number of platforms

- Remember that there are also fees involved which can end up being quite costly. For example, many property crowdfunding models will charge you an initial finder's fee. The exact amount that you will pay will depend on the platform that you opt for, but you can expect to pay anything between 5 and 10 per cent. These are costs that you should be factoring in when you decide whether or not property crowdfunding is the right investment for you

- Furthermore, some will also require you to pay on top of an initial finder's fee a management fee on the yield too. You can expect to pay between 10 and 25 per cent for this.

- There may also be a capital gains fee of another 15 per cent, but this is not necessarily the case between all the platforms.

What is an income protection plan?

If you have a mortgage or decide to take out bridging finance, one thing you may be worried about as a borrower is running the risk of defaulting on repayments at some point in the future, meaning that you are concerned about the risk of ending up in a cycle of debt, or even worse, potentially losing your home completely. However, sometimes we can try to do whatever we can to keep fit and healthy, or keep our finances in check, and still end up in a financial emergency because of an unexpected illness. This is where an income protection plan can help you. But what exactly is this? We explain everything you need to know.

What is income protection insurance?

This used to be under another name, known as permanent health insurance (PHI) and it is a type of insurance protection policy that would be able to help you in the event that you find yourself unable to work for an extended period of time, due to injury or illness.

Otherwise known by its acronym IP, this is a protection plan that will pay out for a number of years (until retirement, death or until you return to work, depending on the individual circumstances). Nevertheless, it is also possible to get a short-term IP policy (also known as Stips) if you are looking for a similar policy with lower overall costs.

However, it is worth noting that these types of policies do not pay out if you end up becoming redundant, but you may be able to provide you with some form of back to work support if you are off due to illness.

Why should I get an income protection plan?

According to the consumer body and-ppi/income-protection/income-protection-explained-aum068h7cqr3">Which? whilst many of us do not currently have an income protection policy in place ( in fact, it is estimated that less than 9& of people in the country have this type of insurance, compared to 16% who have bought private medical insurance, and 41% who have taken out life insurance), it is nevertheless something that each and every working adult in the UK should consider. But why?

There aren't many employers in the UK who will cover their staff in the event that they need to take off a year or more due to becoming ill. With so many bills that will continue to be needed to be paid for, such as mortgages, this can be an extremely heavy burden on not only the person in question who is ill, but also supporting family members who may need to take on additional work in order to cover the costs of their partner or close family member being out of work. Clearly, this can put an enormous amount of stress on all concerned.

Furthermore, there is a low level amount of support available when it comes to state benefits, meaning that you will not necessarily be covered for the full amount you need in order to sustain your previous lifestyle, as statutory sick pay rates currently in the UK are up to £92.05 a week for up to 28 weeks.

How much does income protection pay out?

If you decide to get an income protection plan policy and need to use it, then you can expect to receive anywhere from 50% to 70% of your normal earnings. These payments are made to you on a tax-free basis.

It is worth remembering that these types of policies will only pay out in the event that the pre-agreed period has passed at the point at which you make a claim. This exact time frame will be dependent on the IP provider in question, but it can be from just one month, up to twelve altogether. To cut down on costs of taking out this type of insurance policy, take note of the fact that if you choose a deferral period with a longer time frame, the lower your overall premiums will be.

How much does IP cost?

There will be different factors at stake when it comes to the exact amount that you will end up paying (for example as similar with other kinds of health insurance policies, IP providers will be looking at things such whether your smoke, if you are in good health or not, as well as the level of cover that is required). However, it is worth noting that the type of job you have also plays a role, with a number of IP insurers dividing people into four categories as listed below:

- Class 1: Professional: managers, computer programmers, secretary

- Class 2: Those considered to have the high business mileage or skilled manual work

- Class 3: skilled manual works or semi-skilled workers: plumber, teacher

- Class 4: those that fall into the heavy manual worker or unskilled worker category

How does capital gains tax on property work?

You will be required to pay capital gains tax, which is the tax that is payable if you have profited from the sale of an asset, in this case, this is your property. However, did you know that this type of tax works differently if you are selling property than it does if you were selling assets such as stocks and shares? This can mean capital gains tax appears more complicated than it in fact is. Octagon Capital explains the vital points you need to know concern capital gains tax on property.

Not everyone pays capital gains tax on property

If you have made gains on your only (or principal) home, it is not usually the case that you will need to pay capital gains tax on it. However, it is likely you will have to pay if you own more than one property.

How do I know if I owe capital gains tax on property?

As previously stated, if you are selling the main home that you are currently residing in, it is usually the case that you are exempt from paying capital gains tax due to a tax relief system that is implemented in the UK, known as 'private residence relief'.

Nevertheless, things change if you are selling a home that you are currently letting out, or if you are intending to sell a second home. There may be ways though that you can reduce your capital gains tax bill (through accessing tax relief) or by deciding to nominate which of your property you would like to be tax-free. So if you are using bridging loans in order to build up a second property and sell it for more, you will likely pay capital gains tax on this.

When will you need to pay capital gains tax on property?

In summary, here are the following situations where you will most likely be required to pay capital gains tax on a property:

- You use part of your property only for business-related matters

- You purchased a property specifically for the intention of renovating it and then selling it on

- You have moved out of the property for a period of least 18 months, perhaps as you have moved into your partners home

- You have let out a part of your home, or all of it. This does not include if you have a single lodger, as to count not as a tenant you would also need to be living in the building too

- If you sell your total plot (or part of your garden) and including the area you are selling off equates to more than 1.2 acres in size

- You are in property development and are converting a property into flats

Capital Gains Tax rates for property in 2018-19

It is important to be aware of the fact that a proportion of the profits that you make from selling a property can be earned completely tax-free. This is known as being your capital gains tax allowance.

That means that for the 2018/19 tax year, you are able to make £11,700 in profit before you will be liable to pay capital gains tax. This rises to £23,400 if you are married or in a civil partnership.

When it comes to the capital gains tax rates you will pay on the property after this threshold, it will be depending on which tax band you fall under. For example, if you are a basic rate taxpayer, this will mean you will need to pay the equivalent of 18% on capital gains tax for property gains. For higher-rate and additional-rate taxpayers, this rises to 28%.

The tax you need to pay for a second property

You have the option of deciding which home will be tax-free if you use more than one property, and it does not necessarily have to be the property you live in most of the time. You will have a time-frame of two years once you have purchased a property in order to make this nomination. Typically, people in this position decide to nominate the home they expect to make the largest gains when it comes to selling it off.

It is also worth remembering that those who are married or in a civil partnership are only able to have one main home between them. However, couples who are unmarried have the options to each nominates a different home if they so wish.

How does capital gains tax work on gifted or inherited home?

Perhaps you are in the scenario where someone has left their property to you in their will, or your parents or relatives have the intention of giving you the property at a later date. Does this mean you pay capital gains tax?

In this situation, you will inherit the home at its market value at the time of death when you inherit it. Whilst there is no requirement for capital gains tax to be payable on death, the value of the home will, however, be included in the estate (for clarity, this refers to any assets and property taking away the cost of funeral expenses and debts) that will then mean that inheritance tax may be due instead of capital gains tax.

However, you may be liable to pay capital gains tax in this situation if you sell on the property without having made it your own residence, which would otherwise exempt you through private residence relief. If you do pay, the amount you will be required to give will be calculated on the increase in value between the date of the death, as well as the date you sell the property, taking off associated selling costs.

If you fall under the 'gift with reservation' category, (for example, you are provided with a property whilst the homeowner still lives there) you may have to pay capital gains tax if you sell the home. You could also still have to pay inheritance tax too once the gift giver passes away.

Everything you need to know about interest-only mortgages

It is estimated that there are over 1.67m interest-only mortgages in the UK, but how exactly do they work, and what is the difference between interest-only and repayment mortgages? As a bridging loan broker, we understand the importance of knowing the difference between the two so that you can make an informed decision as to what is best for you, and so we've put together a guide explaining in full everything you need to know about interest-only mortgages.

What is an interest-only mortgage?

An interest-only mortgage as the name suggests is where you only pay interest to the mortgage lender on a monthly basis. That means that the capital you have accrued is not paid, just the interest. This will mean that whilst your monthly payments will be less than if you took out a repayment mortgage, you will still end up owing the original amount you borrowed. As a result, that will mean that it is your responsibility as a borrower to find another way in which you can repay the capital at the end of your mortgage term. This is referred to by lenders as organising a separate 'repayment vehicle', and they will be looking for evidence from you of a repayment plan that demonstrates how you will pay the capital back. For many people who have taken out an interest-only mortgage, this will manifest itself in the form of selling other properties or paying a monthly amount separately into a stocks and shares ISA.

The history of interest-only mortgages

Prior to the 2008 financial crisis, interest-only mortgages were much more readily available. This is because, at this point, borrowers were able to make an application on an interest-only basis and be accepted for this type of mortgage without ever having shown the lenders how the debt would end up being repaid. However, after the credit crunch occurred, with financial markets collapsing and house prices plummeting across the UK, lenders realised that hundreds of thousands of people in the country would, in fact, struggle to be able to make repayments on their home loan.

Consequently, the proliferation of interest-only mortgages has diminished considerably in the last decade, and it is now quite difficult to be able to borrow money on an interest-only basis for mortgages. These days, not all lenders even provide the option of interest-only mortgages, with those that do still offer this kind of mortgage only doing so under strict eligibility criteria. Examples of this include:

- A very high minimum income

- A large deposit: depending on the lender the exact amount can vary, but it can be anything from at least 25%, with some mortgage providers requiring you to have a deposit equivalent of up to 50% of the property's value

- You will also need to show a robust repayment plan, and this doesn't simply mean putting some money into a basic savings plan

- It is worth remembering that is is very likely that your lender will carry out periodic checks on your chosen repayment plan, in order to sure that everything is on track and that you will still be able to pay back the required amount at the end of the term.

Interest-only mortgages vs repayment mortgages

Before deciding on which option is better for you, it is worth comparing the main differences between interest-only mortgages and repayment mortgages before making a final decision.

Interest-only mortgages

- Each month you only pay back the interest charged by your lender

- You will still owe the original amount at the end of the mortgage term

- Monthly interest based on full amount original loaned to you. That means that it is possible you end up paying higher interest overall

- It can be risky, as your 'repayment vehicle' may not pay dividends, as there is no guarantee that your investment will end up being enough to pay the mortgage in full when it comes to the end of the term

- Interest-only mortgages do however give you the freedom to invest money that would have been spent paying off the capital on a mortgage elsewhere until the term ends. This means you could end up making a substantial profit if your investments do well.

Repayment mortgages

- Each month you pay the interest charged by your lender, as well as part of the mortgage capital

- Once you reach the end of your mortgage term, you will not need to pay any more as it has already been paid off

- The monthly interest is calculated by looking at the amount you owe on your mortgage at that moment in time. That means that over the course of time, the interest will end up decreasing each month, unlike with interest-only mortgages

- The better equity that you have, the greater the likelihood of receiving a far better mortgage rate.

What to do if you have an interest-only mortgage

It is vital that you carefully consider exactly how you will repay back the capital on an interest-only mortgage before the end of the term. There are a number of different ways you can do this:

- You can decide to remortgage to a better remortgage rate

- You have the option of deciding to switch your mortgage to a repayment mortgage. This will mean that whilst your overall mortgage monthly repayments will increase, you will have the home loan completely repaid by the end of the term

- You could decide to make lump sum overpayments

- You can set up regular overpayments on your mortgage. However, it is worth noting that not all lenders will allow you to do so, so you should always verify with your lender beforehand

- Paying into an investment plan is another way in which you can pay off the capital on your mortgage. Consult a financial advisor for support and guidance as to the best ways to invest your money.

How to tackle tenancy fraud

Tenancy fraud is a very real and serious problem in the UK. Across the country, it is estimated that thousands of homes (mainly housing association and council homes) are being illegally occupied, costing taxpayers billions of pounds each and every year. But what exactly constitutes tenancy fraud? Octagon Capital takes a look at everything you need to know about the issue, as well as signs to look out for.

What is tenancy fraud?

Tenancy fraud refers to a property that is being occupied by a person or a group of people who do not have a legal right to live there. This may be through accessing a tenancy by giving false information and therefore gaining tenancy fraudulently. As previously stated, not only does this costs taxpayer in the UK a considerable amount of money, it also means that in certain situations, people who are in fact in desperate need of accommodation are unable to access housing, due to tenants illegally occupying buildings which then means that there is a shortage of housing that is available on the market.

What types of tenancy fraud are there?

There are a number of different categories of tenancy fraud that one can come across. The ones listed below are those that tend to be the most commonly cited:

- Unlawful subletting: this is when a tenant decides to rent out a part of their home, or the entirety of the property, without having the permission from a landlord to do so, making money from renting out the property whilst they are not living in it. It is important to note that if you are the sub-tenant, knowingly renting out an illegal sublet from someone, you may also be seen as a participant in tenancy fraud, and therefore if caught, you may have to pay a fine (remember, you will also have to deal with the fact that this will most likely appear on your criminal record too, hindering your career and credit applications in the future) due to committing a criminal offence

- Key selling: this refers to the situation whereby a resident is paid to then pass on their keys, receiving a one-off payment for having done so. It is important to note that both parties could face prosecution for having done this, as it will be seen that both parties have worked together in order to commit fraud

- Abandonment: another common scenario regarding tenancy fraud is when a resident stops living in a property and leaves but does not inform the landlord or housing association in order to stop receiving benefits they may have been entitled to as a result of living in the property.

- Getting housing through deception: a person may obtain housing due to having giving false information in their housing application

- Unlawful assignment: a tenant may stop using the property as their main home, but allow another person to live there who has not been granted permission by their landlord, housing association or the local council

- False right to buy (or right to acquire): this is when a resent makes a right to acquire or right to buy application whilst providing false information.

- Keeping a social rented home despite the fact they own another property

Why is it important to tackle tenancy fraud?

For housing management

One important reason that tenancy fraud should be tackled is that if a property has been used for fraudulent means (such as sublet to unauthorised residents, or left completely empty without informing management) then it means the housing provider in question has a lack of control when it comes to housing management. For example, that means that if the landlord is unaware of who is, in fact, living in their rented building, they may not be able to respond as effectively to problems such as repairs or issues regarding anti-social behaviour. This could have not only financial implications for the landlord (in the event that the property is severely damaged by unauthorised tenants) but also for those in the general neighbourhood too if there are problems with anti-social behaviour.

It can be re-let

Particularly when it comes to social housing in the UK, there is a shortage of public housing, and therefore tenancy fraud poses a real problem as it wastes valuable resources. If tenancy fraud is tackled, then it means that this property can then be re-let to another person or family in need, meaning that the building is used by those who genuinely appreciate it.

How to prevent tenancy fraud

There are a number of measures and ways in which the chance of tenancy fraud (or tackling cases of it) can be reduced. These include:

- Thorough identity verification checks: when a person signs up to a new tenancy, transfer or succession, landlords or housing providers should put in place additional checks in the form of verification checks in order to ensure the person is who they say they are. This may include doing a credit reference check, or training staff to focus on being able to identify forged documents

- Tenancy audits: these tend to be a successful way of both deterring as well as detecting cases of tenancy fraud. Visits to residents in their home mean that the landlord can check who is based there as well as ensure that the property is being looked after correctly

- Taking photos: it is becoming far more common for landlords and housing providers to take photographs of the resident as part of the sign-up process. This means that it is possible to verify photos against tenant records, and means that if a tenancy audit is being taken place, photos can be checked during a visit quickly and efficiently.