London Property Market 2021

- Londoners leave the capital

- Foreign investment to remain strong

- Tenant demand to increase

The development of the property market will principally rely on the UK's economic resurgence from the coronavirus. In 2021, the economy is forecast to grow by 5.3%, but the recovery still faces uncertainty.

The pandemic's ambiguity meant it was a challenging year for the property sector, and it's tough to predict how the market will prove in 2021. Despite the ongoing Brexit unpredictability, the outlook for 2021 is largely positive. Industry experts are optimistic that Brexit is not likely to have much of an impact on the housing market in the short term. This year, the London property market will see Londoners continue to leave the capital while investment from overseas remains strong. Tenant demand will begin to increase and, by the end of the year, the rate of rental decline will have slowed.

The London Exodus

The COVID crisis sparked a London exodus, with a sudden scramble to purchase homes on the outskirts of the capital. As the pandemic forced most of the nation to work from home, more and more people chose to leave London. As a result, commuter belts have widened around London and all major cities.

In 2021, the trend is set to continue with more Londoners realising the potential of working from a rural home or commuting once or twice a week. Estate agency Hamptons forecasts that the London exodus will continue for at least the first half of the new year but may slow down as house prices flatline.

Foreign Investment

Foreign investment in the capital is predicted to maintain strong levels in 2021.

Foreign investment from around the globe forms a significant share of London's property business. Despite the challenges London is facing, investors abroad have not forgotten the long-term appeal. Recent reports state London is the second-best place for property investment in Europe. The capital had climbed two spots from the previous year's 'Emerging Trends in Real Estate' report (PricewaterhouseCoopers and the Urban Land Institute).

Local and foreign investors alike have been closing on prime property during the stamp duty holiday. Many are raring to close deals before the additional 2% tax returns for international buyers in April. However, many industry experts are confident that the charge will not deter foreign investment.

Renters and Landlords in the Capital

In 2021, the tenancy market may improve in London.

Renters in London were at a shortage in 2020 as tenants encountered financial challenges. Job uncertainty, furlough wage reductions, and redundancies had their effect on the London rented sector. Supply increased substantially in the capital, and some landlords had to accept lower rent to avoid void periods. Central London saw rent fall by 20%, according to statistics from estate agents Chestertons. Other prime London locations saw 15% decreases, and rental prices in Greater London lessened by 4%.

This year, the number of properties available to rent will likely decline. Once restrictions begin to lift, demand is likely to pick up, and the rate of rental decline will lag. If this year sees the economy recover as anticipated, rent will likely resume growth over the course of 2022.

Eco-Friendly 'Green Mortgages' To Become The Norm

- Green mortgages are a type of mortgage that offers favourable terms for those buying energy-efficient homes.

- These favourable terms can include cashback on green mortgages or lower interest rates.

- Those looking to qualify will usually need an EPC (Energy Performance Certificate) at A or B.

Recently, the UK population becoming increasingly eco-conscious has allowed 'green mortgages' to find their place in the mainstream market. They offer borrowers preferential rates directly linked to the energy performance of their properties. As a result, it gives home buyers and investors an extra impetus to look at newer, more eco-friendly properties to keep costs down.

What Are Green Mortgage Products?

The fact that many of us aren't aware of what these product options are is one of its most significant struggles. The sector offers better-rate mortgages for properties with eco-friendly energy performances. Therefore, in practice, if you are choosing to buy an energy-efficient property, your mortgage rates will be better!

Research from Intermediary Mortgage Lenders Association (IMLA)found that 43% of borrowers hadn't heard of Green Mortgages. More than a third of borrowers also wrongly believed green mortgages would cost more. The statistics show that around 77% of eco-aware lenders offer green products that are equal to or cheaper than a standard mortgage. Currently, only a relatively small number of lenders provide green mortgages, but the survey saw 29% planning to introduce such a product. A further 35% of agents also plan to advise buyers on green mortgages in future.

Why Are 'Green Mortgages' Becoming Popular?

As of yet, there are only a few lenders in the UK offering better-than-normal rates on eco-friendly properties. However, a growing trend for eco-friendly products across sectors has provided an added incentive for investors. When focussing on eco-trends, it is evident that this is a growing one, with more people becoming dedicated to doing their part against the devastating effects of climate change. This entices more buyers to steer towards eco-friendly products and properties. There are plenty of indicators that eco-friendly mortgage products will improve in number. Lenders and advisers alike are beginning to recognise the potential of green mortgages and advise buyers accordingly.

The effects of the Covid-19 lockdown may have spurred this by providing a glimpse of a world with reduced carbon emissions. As a result, the growth of green finance is sure to continue to accelerate. The IMLA also reported that 74% of lenders think green mortgages will be more significant in the finance sector in future, and increased interest has already been noted since the pandemic outbreak.

The reasons for this growth in popularity are vast and varied, but most regard either the environmental or financial factors. Some buyers wish to improve their carbon footprint by living in a more environmentally friendly property. However, cost savings entice more than half (53%) of consumers.

What Are the Eligibility Criteria for a Green Mortgage?

While each lender will have their own set of eligibility criteria for green mortgages, some common requirements include:

- Need to meet a certain level of energy efficiency

- Will need an EPC (Energy Performance Certificate) at A or B

- The property is a new build

Your eligibility for a green mortgage, as with any other type of mortgage, will be dependent upon a range of different factors, and can be greatly influenced by your current circumstances and financial situation. For example, if you have an adverse credit history, or an unstable income the lender may be more hesitant to approve the mortgage.

If you're unsure about your eligibility for a green mortgage, or a mortgage altogether, it might help to discuss your options with a mortgage broker. Mortgage brokers can help advise you on the options that'll work best for you, basing this off of your current circumstances and other details you provide them with.

What Issues Does The Green Market Face?

Eco-friendly properties face the problem of cost when going green. 27% of property owners agree that affordability is an issue for them. Many investors do not find it worth the price of improving energy efficiency. To combat this, the Government has created The Green Homes Grant which could act as a great incentive. Green mortgages work as a great alternative option for customers, but there are considerable barriers which still stand in the way towards growing the green finance sector.

The Government has committed to making Britain carbon-neutral by 2050 and, to do so, the existing housing stock will have to make changes to create more energy-efficient homes.

Will First-Time Buyers Set To Receive Low-Deposit Mortgage Deals?

Prime Minister Boris Johson has pledged 95% mortgages for two million first-time buyers. The Government unveiled plans for 'generation buy' at a virtual Conservative Party conference. The Prime Minister said: "We need now to take forward one of the key proposals of our manifesto of 2019: giving young, first-time buyers the chance to take out a long-term, fixed-rate mortgage of up to 95 percent of the value of the home — vastly reducing the size of the deposit."

How Will It Work?

The Government has revealed intentions to make 95% mortgages more extensively available for first-time buyers, but it is still uncertain how the proposals would work. The Prime Minister discussed the issue facing two million prospective first-time buyers who could afford to pay mortgage repayments but are having difficulty getting approved for a home loan. He believes the Government has a role to play in unlocking low-deposit loans to generate 'the biggest expansion of homeownership since the 1980s'.

The proposal is also reminiscent of government-backed low-deposit mortgage schemes introduced after the 2008 crash. A similar program was launched as part of the Help to Buy plan during the 2008 recession because of banks withdrawing their high loan-to-value mortgage products. Previously, there were 100 percent loans on offer for buyers.

The Government has not released any details on how the scheme might work. According to a report by The Telegraph, one prospective design is for banks to get rid of the rigorous stress tests that were introduced after the financial crash. Rather than the stress tests, the Government could impose a guarantee for these higher loans. This would remove the risk placed on lenders, allowing them to offer low-deposit loans without worry. The tests are designed to assess whether a buyer will keep up mortgage repayments should interest rates rise from their current rate of 0.1%.

How Could The Scheme Help First-Time Buyers?

Boris Johnson said that the scheme will help up to two million people who can afford mortgage repayments but can't currently find home loans. While high loan-to-value mortgages were widely offered at the begging of this year, the COVID lockdown caused many lenders to withdraw their products. Banks and building societies were inundated with a backlog of inquiries when the housing market reopened, and some became overwhelmed with the demand. The decision to remove the low-deposit mortgages may have been due to economic uncertainty - as the economy walks a tightrope many lenders wish to distance themselves from providing riskier loans.

In theory, first-time buyers will be able to buy with a five percent deposit once again under the new proposals. The result hopes to "turn Generation Rent into Generation Buy." However, buyers should still be aware of the possible risks that remain. When you buy a property with a low deposit, there is often a greater risk of negative equity if the property market doesn't rise but instead declines.

How Does The Stamp Duty Holiday Work?

What is stamp duty?

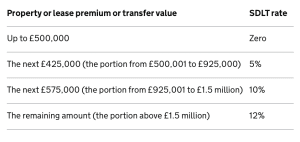

Stamp Duty Land Tax is a tax on the purchase of properties. Stamp duty is only paid in England and Northern Ireland. The devolved administrations of Scotland and Wales have alternative property taxes (Land and Buildings Transaction Tax and Land Transaction Tax, respectively). How much tax you owe the government depends on the property value, and where you are in the UK. The temporary changes to stamp duty currently in place only apply in England and Northern Ireland.

What has changed?

The threshold for stamp duty has been increased temporarily to £500,000 for properties in England and Northern Ireland. This applies to anyone purchasing their primary residence. If your property costs up to £500,000, you will not pay any stamp duty. Higher-value properties will only be taxed on their cost above that amount, potentially saving buyers tens of thousands of pounds.

Before the new policy was introduced in July, buyers paid stamp duty in England and Northern Ireland on land or property with a value of £125,000 or more. The first-time buyer discount allowed those entering the property market to pay no stamp duty up to £300,000 but is now replaced by the stamp duty holiday.

Landlords and second-home buyers will also see a tax cut but will still be eligible to pay the extra 3% stamp duty that has always been allocated to them.

Who benefits?

The stamp duty holiday was put in place to help buyers in a time when many are facing financial hardships as a result of the coronavirus. Chancellor Rishi Sunak has suggested that with the new policy, the average saved on a stamp duty bill is £4,500. Moreover, nearly nine out of ten home buyers this year will pay no stamp duty at all.

While it is aimed at buyers, homeowners are also benefiting and pocketing some extra money. With the policy in place, homeowners have more of an incentive to keep their asking price high, knowing that the buyer is saving on stamp duty. This is particularly significant with the sale of high-value properties which can run a stamp duty bill of tens of thousands of pounds. The stamp duty savings will likely end up being shared, with both buyers and sellers managing to save.

How have house prices been affected?

The Stamp Duty holiday intended to boost the property market after it took a hit during lockdown when house prices fell consecutively for four months. The stamp duty tax holiday has already taken effect by increasing house prices. In August, prices accelerated the most in one month for more than 16 years, according to Nationwide. They describe the sudden recovery as 'unexpectedly rapid'.

On the other hand, fears have begun to muster that the tax break will encourage those who were intending to buy next year to advance their plans. This could create a vast drop in demand when the tax break ends.

When does the stamp duty holiday end?

The stamp duty holiday in England and Northern Ireland is nine-months long. It began in July 2020 and will end in March 2021. According to HMRC figures, the government usually raises around £12 billion annually from stamp duty land tax. Though, the tax holiday is set to cost the Treasury an estimated £3.8 billion.