Home Truth: Lockdown Caused 21% Reduction in Planning Permission Applications

Lockdown Caused 21% Reduction in Planning Permission Applications

- Same time period in 2019 saw only a 5% decrease from the year before

- North East and Yorkshire & Humber saw the largest drop in planning permission applications during lockdown (27%)

- 87% of planning permission applications were approved in 2020

New research from bridging loans broker Octagon Capital reveals that lockdown had a significant impact on the number of Brits applying for planning permission, with numbers from April, May and June 2020 down 21% on the same time period the year previously.

The research, which analysed gov.uk data, found that the decrease in planning permission applications during lockdown is far more significant than in 2019, where there was only a 5% decrease in applications during the second quarter of the year. In 2018, there was only a 3% decrease.

The good news for those who have applied for planning permission during lockdown is that the likelihood of having an application approved doesn’t seem to have been affected. 87% of planning permission applications in 2020 have been approved, marginally lower than the two years beforehand (88%).

Regionally, the North East and Yorkshire & Humber both saw a 27% drop in the percentage of planning permission applications between the second quarter of 2020 and the same period of 2019, the largest in the country. On the other hand, the South West has seen a 17% decrease, which is the lowest.

See also:

Rise in mortgage approvals 'highest in 13 years'

Dan Kettle: 'Bridging volumes halve in Q2'

Sunak approves stamp duty change

Percentage difference in the number of planning permission applications between Q2 2019 and Q2 2020

|

Region |

Percentage Difference in Planning Permission Applications, Q2 2019 – Q2 2020 |

|

North East |

-27% |

|

Yorkshire & Humber |

-27% |

|

North West |

-23% |

|

East of England |

-22% |

|

South East |

-22% |

|

West Midlands |

-20% |

|

East Midlands |

-19% |

|

London |

-19% |

|

South West |

-17% |

Planning permission applications in the North East were the most likely to be approved during lockdown, with a 94% approval rating. Meanwhile, only 79% of applications from London were approved, the lowest rate nationwide.

Dan Kettle, Commercial Director at Octagon Capital, commented: “COVID-19 has impacted every aspect of our lives, but the 21% drop in the number of planning permission applications during lockdown is particularly telling when it comes to looking at how Brits are prioritising their finances during a difficult time.

“There are positives from this research for those who still want to expand, for example to build a home office to help them work from home. The approval rate for planning permission applications has remained high and at the similar level to 2019. The best way to ensure your application is approved is to do your research beforehand and bringing in an architect to ensure your plans are up to scratch.”

To find out more about Octagon Capital and how planning permission has been impacted by lockdown, visit: https://octagoncapital.co.uk/guides/lockdown-caused-21-reduction-in-planning-permission-applications/

How Does The Stamp Duty Holiday Work?

What is stamp duty?

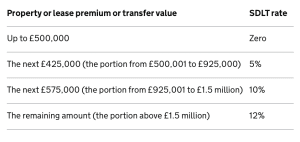

Stamp Duty Land Tax is a tax on the purchase of properties. Stamp duty is only paid in England and Northern Ireland. The devolved administrations of Scotland and Wales have alternative property taxes (Land and Buildings Transaction Tax and Land Transaction Tax, respectively). How much tax you owe the government depends on the property value, and where you are in the UK. The temporary changes to stamp duty currently in place only apply in England and Northern Ireland.

What has changed?

The threshold for stamp duty has been increased temporarily to £500,000 for properties in England and Northern Ireland. This applies to anyone purchasing their primary residence. If your property costs up to £500,000, you will not pay any stamp duty. Higher-value properties will only be taxed on their cost above that amount, potentially saving buyers tens of thousands of pounds.

Before the new policy was introduced in July, buyers paid stamp duty in England and Northern Ireland on land or property with a value of £125,000 or more. The first-time buyer discount allowed those entering the property market to pay no stamp duty up to £300,000 but is now replaced by the stamp duty holiday.

Landlords and second-home buyers will also see a tax cut but will still be eligible to pay the extra 3% stamp duty that has always been allocated to them.

Who benefits?

The stamp duty holiday was put in place to help buyers in a time when many are facing financial hardships as a result of the coronavirus. Chancellor Rishi Sunak has suggested that with the new policy, the average saved on a stamp duty bill is £4,500. Moreover, nearly nine out of ten home buyers this year will pay no stamp duty at all.

While it is aimed at buyers, homeowners are also benefiting and pocketing some extra money. With the policy in place, homeowners have more of an incentive to keep their asking price high, knowing that the buyer is saving on stamp duty. This is particularly significant with the sale of high-value properties which can run a stamp duty bill of tens of thousands of pounds. The stamp duty savings will likely end up being shared, with both buyers and sellers managing to save.

How have house prices been affected?

The Stamp Duty holiday intended to boost the property market after it took a hit during lockdown when house prices fell consecutively for four months. The stamp duty tax holiday has already taken effect by increasing house prices. In August, prices accelerated the most in one month for more than 16 years, according to Nationwide. They describe the sudden recovery as 'unexpectedly rapid'.

On the other hand, fears have begun to muster that the tax break will encourage those who were intending to buy next year to advance their plans. This could create a vast drop in demand when the tax break ends.

When does the stamp duty holiday end?

The stamp duty holiday in England and Northern Ireland is nine-months long. It began in July 2020 and will end in March 2021. According to HMRC figures, the government usually raises around £12 billion annually from stamp duty land tax. Though, the tax holiday is set to cost the Treasury an estimated £3.8 billion.

What is Regulated and Unregulated in Bridging Finance?

Bridging loans or bridge finance, will typically fall under regulated or unregulated activity - and this can have quite an impact on the application process, eligibility and terms that you receive. In this article, Octagon Capital aims to explain the difference between regulated and unregulated bridging - and how you can find the best product for you.

As a rule of thumb:

- Any residential bridging is regulated (if it is their primary residence)

- Any commercial bridging is unregulated (including offices, garages, warehouses)

| Regulated Bridging | Unregulated Bridging |

| 70% Maximum LTV | 75% Maximum LTV |

| First and Second Charge | Mostly Second Charge |

| Subject to Status | All Credit Statuses Considered |

What is the regulation for bridging loans?

When it comes to regulated bridging loans, the FCA is the main regulator in the UK for any mortgages or deals. Essentially, they have strict regulation and guidelines in place to ensure that borrowers do not risk losing their primary residence when borrowing and there is adequate protection in place.

So typically, you can borrow against residential properties, such as buying a place for buy-to-let purposes. However, you cannot borrow a regulated bridging loan if it is secured against your own primary residence.

Part of this is the Mortgage Credit Directive (MCD) which is an EU framework for mortgage firms and is overseen by the FCA. There are a number of measures in place to offer transparency to customers, such as showing them any rates beforehand as an APRC and also giving applicants a reflective period in case they want to change their mind or request more information.

For the regulation surrounding SMCR, this is for senior managers of investment firms under the FCA - and does not apply in this case.

Borrowing against flats and places of primary residence will typically fall under regulated activity

Regulated bridging loans and mortgages are available by first charge or second charge

First charge loans

This refers to the 'first charge' that is taken from your bank account each month, so often refers to as your first mortgage, which could be against your main residence and property that you live at, or an investment.

Second charge loans

This refers to the 'second charge' from your bank account, taken out after your first charge. So you could have a mortgage against your home (this is your first charge) and then another mortgage or bridging loan against an investment product (this is your second charge). You can also get a second charge against your existing home, known commonly as a second mortgage.

Importantly, the amount you can borrow on your second charge is less than your first charge, since it is second in the queue when it comes to repayments each month.

You can use the same lender for both first and second charge, or use a different one for each.

What is unregulated bridging loans?

When bridging loans are unregulated, they are conforming to some essential guidelines, but there are a lot of flexibilities when it comes to the criteria and lending to people with adverse credit histories. Loans in this nature are commonly by means of second charge, and with faster processing and applications, they typically make up around 50% to 60% of all bridging deals (regulated rarely gets more business than unregulated in this sector).

Unregulated business is often for commercial properties including:

- Offices

- Petrol garages

- Schools/ Hotels/ Farmhouses

- Warehouses

- Factories

- Gyms

- Other business purposes

What does non-status bridging loans mean?

Non-status bridging means that it does not take credit status into account. So where regulated mortgages and most financial products require a strong credit score, this is not the case with non-status lending. Therefore, lenders are willing to take a view on adverse credit histories or limited credit histories and may look at other factors such as the potential value of your property and the opportunity.

Storage Wars: UK Cities Paying Nearly Double for Self-Storage

- Londoners pay 107% more per week than average for a 50 sq. ft. storage unit

- Camden is the most expensive place to rent storage space in the UK (up to £101.63 p/w)

- Local 100 sq. ft. units cost 8% of a Londoners average wage, 7% of Swansea and 6% of Manchester, Liverpool and Newcastle

New research from bridging loans broker Octagon Capital reveals the cities in the UK getting the worst deals on self-storage units, with Londoners paying significantly over the odds at a rate 107% higher than the national average.

Looking at the average cost of a 50 sq. ft. unit in locations around the country (ideal for storing the contents of a one bedroom flat), London is the most expensive, with customers likely to spend an average of £1,797 per year.

Considerably higher than second place Swansea, which has an average of £1,006 per year for the same sized unit. Exeter residents are getting the best deal in the country, paying 31% less than the nationwide average (£598 p/y).

| Average annual cost for 50 sq. ft. unit (£) | Percentage Difference from Nationwide Average | |

| London | 1,797 | 107% |

| Swansea | 1,006 | 16% |

| Liverpool | 958 | 10% |

| Edinburgh | 892 | 3% |

| Manchester | 882 | 2% |

| Bristol | 833 | -4% |

| Newcastle | 803 | -7% |

| Cardiff | 765 | -12% |

| Birmingham | 745 | -14% |

| Glasgow | 700 | -19% |

| Portsmouth | 650 | -25% |

| Southampton | 650 | -25% |

| Exeter | 568 | -31% |

| Nationwide Average | 868 |

This trend continues when looking at 75 and 100 sq. ft. sized units, ideal for a two-bed flat or house, with London topping both tables and costs averaging 110% and 100% more than the average respectively. Liverpool similarly finds itself at the top end of the table for each unit size analysed, paying 12% more than average for 75 sq. ft. (£1,238 p/y) and 17% more for 100 sq. ft. (£1,674 p/y).

Camden in London has the highest individual costs per year for 75 sq. ft. and 100 sq. ft. units (£3,542 and £5,285 p/y respectively), while also placing second for 50 sq. ft. (£2,909 p/y) behind Kennington (£3,024 p/y).

Even when taking into account the average weekly wage in areas around the country, Londoners are still paying over the odds. For example, a 100 sq. ft. storage unit costs 8% of the average weekly wage of a Londoner, compared to just 3% of Portsmouth residents at the other end of the table. On average, 5% of the weekly wage would be spent on a storage unit in London of this size.

Dan Kettle of Octagon Capital, commented: “There are many factors that affect pricing in cities around the UK, but the large difference in costs between London and the rest of the UK is still significant when you take into account the proportion of the average wage that relates to.

“The best way to get a good deal on self-storage is to ensure you select the right sized unit so you’re not overpaying on space, and always shop around. There may be a better deal with a different company and don’t forget to try and negotiate costs.

“At Octagon Capital we provide bridging loans to assist those looking to embark on a project such as a move, renovation or refurbishment where self-storage is often needed.”

References

Data consists to quotes for various sized self-storage units by Big Yellow, Safestore, Shurgard and Lok’nStore on w.c. 29th July 2020, with annual costs reflecting the weekly cost multiplied by 52

Average wage data via Centre for Cities: https://www.centreforcities.org/data-tool/#graph=map&city=show-all&indicator=average-weekly-workplace-earnings\\single\\2019

How Much Deposit do I Need for a Bridging Loan?

When you enter a bridging loan, you will usually need to put down a deposit. This is a lump sum paid upfront. The amount you will need to pay as deposit depends on the amount you want to borrow, the value of the property you are looking to purchase and the LTV (which is dictated by your lender).

When you enter a bridging loan, you will usually need to put down a deposit. This is a lump sum paid upfront. The amount you will need to pay as deposit depends on the amount you want to borrow, the value of the property you are looking to purchase and the LTV (which is dictated by your lender).

Your deposit will be at least 20% to 25%, as the LTV available on a bridging loan is 70% LTV or 75% LTV unregulated. The deposit represents the proportion of the property you own outright, the LTV is the rest of the property which you pay off with a bridging loan.

What is LTV?

LTV (otherwise known as the Loan-to-Value) is the ratio lenders use that shows how much you may be able to borrow versus the value of the asset you want to borrow against.

For example, if you wanted to purchase a property worth £100,000 and wanted to borrow £75,000, the LTV of the loan would be 75%. Your deposit would be the other 25% which would be £25,000.

LTV Key Features

- Borrow up to 75% LTV regulated

- Borrow up to 100% LTV unregulated

- No deposit bridging loans available

- 100% LTV may require additional secured asset

What is the difference between regulated and unregulated LTV?

Currently only part of the bridging loan industry is regulated by the FCA. The FCA are the Financial Conduct Authority, which regulate financial services firms in the UK with the goal of protecting consumers and ensuring the integrity of the UK financial industry.

A regulated bridging loan would be one which falls under the protection of the FCA, these are usually residential ones. Regulated bridging loans aim to offer consumers a heightened level of protection and peace of mind.

At this time, all commercial bridging finance is unregulated, meaning the FCA does not supervise this area of the industry. If you’re securing a loan for an investment property, a commercial building, or for a buy-to-let it will not be regulated, meaning you VTL will be 75%.

Can I get a bridging loan with no deposit?

Yes, you can get a bridging loan without putting down a deposit. However, you may need to look at different types of products such as mezzanine finance. Mezzanine finance allows companies to give up some of their equity to secure a loan. You can find out more about mezzanine finance here.

Yes, you can get a bridging loan without putting down a deposit. However, you may need to look at different types of products such as mezzanine finance. Mezzanine finance allows companies to give up some of their equity to secure a loan. You can find out more about mezzanine finance here.

Can I Use a Bridging Loan for a Deposit?

Yes, you can use a bridging loan as a deposit on a property. Bridging loans are commonly used by those stuck in between the purchase of a new property and the sale of their current one, not wanting to lose their dream home by delays in selling their existing home.

These types of borrowers can use a bridging loan to pay for a deposit on a new property, which can then be repaid once their existing house is then sold. In these types of situations, bridging loans can offer a temporary solution, with borrowers able to secure their dream house and not miss out before their current house is sold.

What is a Bridging Loan Used For?

A bridging loan can be a quickly and easy way to get a loan in the short term. In contrast to getting a mortgage which could take months, a bridging loan can be in your account in between 2 to 4 weeks. Generally, bridging loans are used by property owners, developers or investors, often when they are urgently looking to complete on a property and a traditional mortgage would take too long.

Bridging loans allow you to borrow anywhere from £50,000 to £25 million and receive the lump sum in 2 to 4 weeks, sometimes sooner. Finding a bridging loan can be difficult but by using a broker like Octagon Capital you will have an advisor to ensure you get the best rates and terms for your unique situation.

How does it work?

To secure a bridging loan you will need to agree the terms and rates with the lender, usually through a broker, and put down a deposit. The money that you borrow will be held against the property. A bridging loan is only designed to be used as a short-term measure, which is why the interest rates are generally higher than something like a mortgage. find out more about the cost of a bridging loan here.

What are the advantages of a bridging loan?

One of the big advantages to a bridging loan is the speed with which it can be processed. A bridging loan takes an average of 2-4 weeks for the money to be in your account as a lump sum, which is considerably quicker than something like a mortgage.

Another big advantage to a bridging loan is that all credit scores are considered. Unlike a mortgage, your credit score isn’t a barrier to you borrowing money when you use a bridging loan.

Common reasons for bridging loans

Scenario 1: moving to a new house

One common use for a bridging loan is to the ‘bridge the financial gap’ between one property and another. When you’re moving house it’s not always possible to sell immediately and if you’ve found a property you love a bridging loan could give you the finances you need to secure the purchase of that property while you wait for your current property to sell.

For example, client A is looking to move home, they’re currently living in a property worth around £300,000 and are looking to downsize. They can’t sell their house straight away but they’ve found a property that’s perfect for them which is on the market for £200,000. They are waiting for their current their property to sell and need to use the equity in the property. They take out a bridging loan for £200,000 with an interest rate of 1% to purchase the new property. Their property sells three months later, and they can pay off their bridging loan in full. The bridging loan has cost them £6,000 in total interest and they have save themselves the hassle of taking out a mortgage which would have slowed them down causing them to miss out on the property they wanted. In a scenario like this, a bridging loan is a perfect option to secure the purchase of a property quickly without having already agreed a sale on a property you currently own.

Scenario 2: flipping a property

For anyone looking to purchase a property and renovate to resell, a bridging loan can be a quick and easy way to secure the funds you need to purchase and renovate the property./FlippingHousePrimaryResidence-Maskot-GettyImages-59caace1af5d3a00112dce99.jpg)

For example, client B is looking to refurbish a property which is on the market for £150,000 and then resell. The property needs £60,000 of refurbishments and it will take around 8 months to complete. He agrees in principle a bridging loan of £210,000 at an interest rate of 1% per month. With a bridging loan he becomes a cash buyer and is able to negotiate the property down to £125,000, so he now takes a bridging loan of £185,000. This loan will be enough to cover the purchase of the property and all the renovations he needs to do. Every month he will pay £1,850 in interest, so the loan will cost him £14,800 in total interest while he spends the 8 months renovating the property. Now that the house is renovated, he sells for £275,000. Now he can pay the loan back in full and he has still made a profit of £75,200 on the property.

Scenario 3: buying at auction

For those who are looking to purchase a property at auction a bridging loan can be a good option. When you buy a property at auction you are required to pay a 10% deposit on the day and sign a legally binding contract to pay the remaining 90% within a 28-day period.

Because of this 28-day window to purchase the property in full, a bridging loan can be the perfect way to quickly acquire the funds you need. Although a bridging loan is usually quick to acquire there are ways to speed it up. It is a good idea to get a loan in principle before you look to buy at auction. Being approved in principle by your lender means that the lender will provide you with a statement saying that they will lend a certain amount to you before you have purchased the property at auction. Not only will this speed up the process of getting your bridging loan, but it also means you have some peace of mind that you are likely to get your loan. Bridging loans should only ever be a short-term measure, so if you’re buying at auction you should have a clear exit strategy for how you intend to pay off your loan.

Scenario 4: construction finance

You can also use a bridging loan to fund a construction project, whether that be a property or otherwise. With Construction finance loans you can borrow up to £2 million towards a construction project of your choice.

For example, client C is looking to build a house to sell. They agree a bridging loan of £1.5 million at 0.7% interest to fund the project, which takes them a year to finish and then another month to sell. They borrow the money for a total of 13 months, meaning they will pay £10,500 every month for a total interest payment of £136,500. Once their project is complete, they sell for £2.5 million and pay off their loan in full. After their bridging loan has been paid off, they have made a profit of £863,500.

How Much Does a Bridging Loan Cost?

Bridging loans can be a quick and easy way to get the finances you need to secure the purchase of a property, avoiding the often lengthy process of applying for a traditional mortgage.

Generally, bridging loans have a higher rate of interest than a traditional mortgage or loan, which can make them seem an expensive way to borrow money.

Bridging Loan Key Features:

- Can be a quick and easy process

- Interest starts from 0.44% per month

- Designed for short-term use

- Secured loan

- Can borrow between £50,000 - £25million

- Borrow for 3 to 24 months

The important thing to remember is that a bridging loan is only ever designed to be used as a short-term measure. Unlike a mortgage, a bridging loan is designed to be used for 3 to 24 months. The advantage of using a bridging loan is that you can receive your loan quickly in order to secure the purchase of a property.

How much does a bridging loan cost?

The interest on a bridging loan starts from just 0.44% per month. However, depending on level of risk associated with the loan or your credit status the interested may be higher.

For example:

Client A is looking to refurbish a property which is on the market for £100,000 and then resell. The property needs £50,000 of refurbishments and it will take around 6 months to complete. He agrees in principle a bridging loan of £150,000 at an interest rate of 1% per month. With a bridging loan he becomes a cash buyer and is able to negotiate the property down to £90,000, so he now takes a bridging loan of £140,000. Every month he will pay £1,400 in interest, so the loan will cost him £8,400 in total interest while he renovates the property. Now that the house is renovated he sells for £190,000. Now he can pay the loan back in full and he has made a profit of £41,600 on the property.

It is worth noting that other fees such as the lender fee (2%), the broker fee (1%) and any additional solicitor and valuation fees you incur are payable on top of your interest.

How does this compare to the price of a mortgage?

There are a lot of factors that can affect the rates of a bridging loan and a mortgage, but generally a bridging loan will have a higher rate of interests. This does not mean that bridging loans are always the more expensive option. Bridging loans are only used for between 3 to 24 months, where as interest on a mortgage is usually paid for around 25 years.

A mortgage is a good option for anyone looking to borrow money long term, paying off the purchase of a fist property for example. Whereas a bridging loan offers a quicker way for property investors or owners to bridge the gap between one property and another.

For example:

Client B wants to downsize from a £500,000 property to a smaller £350,000 property. Instead of selling and then having to rent in the interim or apply for a mortgage and risk missing out on the house they want, they choose a bridging loan. They take out a loan of £350,000 to buy the new property, knowing that they will pay it off in full once the original property is sold. They borrow at an interest rate of 1% for 3 months, until the first property is sold. Their total interest payment is £10,500.

There are lots of factors that can affect the rates on a bridging loan and if you have questions the best thing to do is seek advice from a professional. By getting in contact with a bridging loan broker like Octagon Capital you can feel confident that you are getting the best possible terms and rates on your loan. Different lenders will offer different rates and terms, using a bridging loan broker means you can explore all these options and find the best loan.

There are lots of factors that can affect the rates on a bridging loan and if you have questions the best thing to do is seek advice from a professional. By getting in contact with a bridging loan broker like Octagon Capital you can feel confident that you are getting the best possible terms and rates on your loan. Different lenders will offer different rates and terms, using a bridging loan broker means you can explore all these options and find the best loan.

How Quickly Can I Get a Bridging Loan?

A bridging loan can be a good option for anyone who needs a loan quickly and easily. There are many reasons why you might need a bridging loan, but a bridging loan can be a good option for anyone who wants to complete on a property quickly.

One of the big advantage of a bridging loan is the speed with which you can receive the money. The time it can take to be approved for a traditional loan can vary depending on the type of loan you need and the provider you are going with.

A standard mortgage approval process is supposed to take "between 18 and 40 days". However, there is no guarantee where you might fall on this widely-quoted timescale. If you look on finance forums you will find that “between 18 and 40 days” does not seem to cover peoples own experiences dealing with getting a mortgage. Applicants talk about the process taking 16 weeks or more.

How long will it take to get a bridging loan?

With a bridging loan receiving your money can be quick and easy. At Octagon Capital, the lenders we work with are able to send the entire funds to your bank account in one lump sum. This usually takes just 10 to 14 days after the loan has been approved. There is an average of 2 to 4 weeks from the start of your application to completing and receiving your funds, although this can happen much sooner.

With a bridging loan receiving your money can be quick and easy. At Octagon Capital, the lenders we work with are able to send the entire funds to your bank account in one lump sum. This usually takes just 10 to 14 days after the loan has been approved. There is an average of 2 to 4 weeks from the start of your application to completing and receiving your funds, although this can happen much sooner.

How can you speed it up?

A large part of how long your loan will take to get to you depends on the lender and broker. However, there are ways that you can speed up the process and ensure you get your loan as quickly as possible.

You can speed up the process of receiving your bridging loan if you already have a loan in principle from your loan provider. Being approved in principle by your lender means that the lender will provide you with a statement saying that they will lend a certain amount to you before you have finalised the purchase of a property. When you have a loan in principle much of the admin has already happened and you will have been approved on the initial terms of your loan, this means the process can be much quicker when the time comes to secure your loan.

Make sure you have you have your information ready. Once you’ve been approved for a new bridging loan in principle, your lender will let you know exactly what they need to progress to a full offer. Have your information ready to go to speed up the process, a lender will usually ask for documents including the following:

- Confirmation of ID

- Confirmation of an exit strategy (how do you plan to pay the loan back)

- A property valuation etc.

Getting a property valuation can be a long process, so to make getting your bridging loan as quick as possible, make sure you have already got your property valuation. A property survey can take between 6 and 12 weeks, so if you wait to start until you have applied for a bridging loan this will definitely slow down your application.

Because there is no sure-fire way to get a bridging loan immediately, it’s always best to apply for your loan before going to auction or being ready to complete. This way you’ll be ready to complete or buy at auction with your bridging loan already secure as a posed to having to hold up your purchase because you’re still waiting for the funds to come through.

If you have any questions about getting a bridging loan get in contact with one of our advisors today and they can guide you towards the perfect bridging loan for you.

Does taking out payday loans affect your chances of getting a mortgage?

No, taking out a payday loan does not affect your chance of getting a mortgage. According to different mortgage advisors and brokers that we have confirmed with, most providers consider a payday loan to be like 'any other loan' regardless of the fact that it is commonly used by people who are pay cheque to pay cheque.

When applying for a mortgage, you will commonly undergo checks of your credit history and affordability - and this will include looking at any previous credit cards, personal loans and bills that you have had and how well you have repaid them.

Many applicants worry that having a payday loan in the past will affect them for future mortgages and bridging loans - but this is not the case.

What is a payday loan?

A payday loan refers to borrowing a few hundred pounds (around £100 to £1000) and receiving the money upfront, and repaying in full on your next payday. It is often used by people who cannot wait until their next payday to pay for something and need the money upfront. It is best suited for emergencies, including:

- Car repairs

- Household bills

- Medical bills

However, payday loans are also often abused for shopping and gifts.

Around 5.4 million payday loans online were issued in the last year in the UK by around 40 lenders, according to the FCA.

Note that the number of active payday lenders in the UK is decreasing rapidly since the number of lenders able to withstand FCA regulation is falling.

Why is a payday loan considered bad for a mortgage?

For some mortgage brokers and lenders, they consider payday loans to be bad for mortgages. This is because such loans are regularly used by people who are behind on their bills and desperate for funds, hence their eligibility for a mortgage should be questioned.

Some lenders will consider, if a person cannot make it until payday, how can they pay for a mortgage and bills every month?

However, rest assured, most mortgage providers look at payday loans as being 'like any other loan' because many will consider that emergencies can occur that can put you behind your payments.

For instance, if you live in rented accommodation and have a large heating bill, have to help out your family or pay for a funeral, borrowing £500 and repaying it back on time should not stop you getting a mortgage and moving up in life.

Some lenders will be stricter than others

Regrettably, some mortgage lenders will be dismissive of payday loans and people that use them and it may jeopardise your ability to receive a mortgage offer.

However, it is noted that every mortgage lender is different and in this day and age, we live in a world of specialist finance companies. The requirements for someone like NatWest and Barclays is going to be very different to someone like Masthaven and Precise Mortgages.

Depends on what terms - how long ago, did you repay?

Some mortgage companies are willing to look at payday loans on a case-by-case basis. For example, if it was taken out several years ago by the individual and repaid on time, this should not impact your chances of getting a mortgage. Lenders may differ as to whether this is 1 year, 3 year or 5 years ago.

Equally, did the borrower take out one payday loan or are they a habitual user and still owning funds. This will be taken into consideration.

Naturally, lenders are concerned about managing risk and if they determine that an individual cannot afford a mortgage, they will base this on multiple factors and not just payday loans.

How To Use Remortgaging to Release Equity

Many homeowners in the UK are taking advantage of low mortgage rates and through remortgaging, are finding ways to release equity from their homes. According to Remortgage Quotes Online, you can switch your standard variable rate (SVR) from around 4-5% APR to a fixed remortgage rate of 1.3-1.7% during the introductory offer.

The result of record low mortgage rates means that you can potentially borrow more money against your home, whilst keeping your mortgage payments each month roughly the same.

Releasing money through remortgaging is mostly used for:

- Home improvements

- Debt consolidation

- Christmas shopping and presents

- Family holidays

- Gifting to other family members

How Can You Release Equity Through Remortgaging?

To be effective, you will need to have the following:

- Good amount of equity in your home

- Good/fair credit rating

- Good affordability to remortgage

- Stable income (not recent fall)

In order to remortgage, you will need to meet the checks from the mortgage provider, which have become more stringent over the years. They want to seem a strong affordability, which means that your salary is stable or going up (not falling drastically) and your expenses are not going beyond your means.

If you have a poor credit rating since getting your original mortgage, this can impact your chances of getting a new mortgage deal - or you could be stuck on your standard variable rate.

Naturally, to release money from your home, you will need some equity in it, which is achieved by paying off your mortgage on time for several years.

We review some of the options below:

Release Money When You Remortgage

When applying for a remortgage, you can ask to release or borrow money too - and the payments will just be adjusted to your existing mortgage loan. You may have heard the phrase or your parents complain "Well, I will need to remortgage the house for that one." And this is exactly the case.

The more equity you have in your home the better, otherwise releasing through a remortgage with little equity will just increase your monthly payments.

Second Charge Loan or Advance

You can get a 'top-up' when you remortgage, also known as an 'advance' or simply a second charge loan.

In this instance, you are getting an additional loan to your mortgage and this will mean having two loans on different terms. One could be fixed for 5 years and the other could be variable for 2 years. You cannot borrow as much with the second loan as with the first and the amount you can borrow is based on your affordability. Failing to keep up with repayments can have a negative impact on your credit history and cause you to lose equity in your home.

Equity Release

This is only available to homeowners over the age of 55 and this allows you to release equity from your home, and pay off your mortgage at the same time. This is becoming an increasingly popular for the ageing population in the UK and is currently used by around 60,000 households per year, who borrow on average around £80,000.

Through equity release, you are able to receive one large sum amount, upfront, which is completely tax-free. In exchange, you simply give up some equity in your home, which is claimed by the lender when you die or go into long term care. There are monthly interest repayments or you can choose to have an interest only or rolled up interest added to the full outstanding amount. You also benefit from the house increasing in value, which is then used to pay off your outstanding debt.

You can typically borrow around around 25% to 60% of your property's value through a lifetime mortgage, which is a type of equity release product designed to last your lifetime. Or if you want to borrow money, you can use a home reversion scheme to borrow up to 80%, but this will mean physically selling of your home and you will not be able to benefit if it goes up in price in the future.