Ways to diversify your property portfolio

For experienced investors that are already feeling the success of property investment, then you are probably looking to further expand your portfolio to maximise your returns. Through diversifying your property portfolio, you have more scope and opportunity to earn money from multiple sources, not to mention the capital appreciation that can be gained from more than one investment.

A diverse property portfolio can help to mitigate risk by spreading assets across different properties that have a different appeal or draw. Whether this be across different locations, through different types of property, or to have a different target tenants, all properties can help to build and strengthen an existing property portfolio. By following simple tips on how to diversify your property, you can help to keep your assets safer, and your income high.

Consider Studio Living

Studios are a great form of investment which can allow investors to diversify their portfolios with a tighter budget. This type of apartment is an emerging form of living, which has become quickly accepted from the likes of students who wish to live in one modern space whilst still being affordable. Young professionals and students are willing to compromise on space for a better location, and as studios are predominately in city centre locations, the proximity to transport links and universities are appealing for many.

Although small in size, this does not compromise on quality. New developments from property investment companies such as RW Invest offer studio living in the midst of bustling city centres, drawing in tenants due to the fantastic location. As city centre living becomes more and more popular, the demand for studios increases, which will see their value rise significantly and make them a secure investment for strong capital gains.

Look for a lower price point

One of the best ways to diversify your portfolio is to source apartments at both ends of your budget. Invest in those that are low cost and more affordable to attract a type of tenant that is not willing to pay over the odds and secure yourself a higher priced property to catch business professionals and alike that require a higher standard of living.

If you live in an area that is particularly expensive it may be worth looking at other property more further afield. More affordable areas in the UK include:

- Liverpool

- Manchester

- Leeds

These provide a stark contrast to the likes of London which is experiencing escalating prices, therefore hindering investors from investing in the capital city.

Think about different property types

Another strategy you can use is to own different types of property. One example of this is student accommodation, which has become one of the UK’s most popular forms of investment in the UK. High demand through a growing student population and reliable yields create the perfect opportunity for investors.

Commercial property may be another form of property to consider, which will help to expand your investment portfolio. Shops, offices and storage spaces are available for property investors to purchase, whilst still producing stable returns despite being a different type of asset.

Houses of multiple occupancy are another form of investment that is becoming more popular for landlords as quite often they gain more rent from having the same size space. All in all, through having a wide variety of property, investors can give themselves stronger protection from potential risks and as a result generate more income across several different properties.

How to sub-let your property?

You may have heard of the term sub-letting, but what does it mean? There are some legal complications which confuse people and it is important to know what they are. It is a common belief that once you are a tenant, you can just do what you want with the property. However, this is certainly not the case.

When you are renting a property, you will likely be renting directly from a landlord who owns said property. It is equally possible to rent directly from another tenant who has rented the property from the landlord/owner. The latter is what is known as sub-letting.

In this guide on Octagon Capital will provide all the information, you will need on the topic of subletting and whether or not you will be allowed to sublet their home.

Before we get started, here are some top tips on subletting:

- Check what it says in your tenancy agreement

- In most cases, you will need to seek out permission. Therefore, you should write to your landlord explaining the situation at hand and ask if they will give you their consent to sub-let.

- Be aware that if you do not do things properly, it may lead to problems on the long-term and down the line.

What is subletting?

Subletting refers to when an existing tenant let’s all of part of their home to another person. That person is known as subtenant, and they have a tenancy for all or part of the property which is let to them. They will also have exclusive use of the accommodation that has been let to them.

For example, if it is the case that you decide to sublet your home, you are giving up possession of it. The subtenant would have exclusive use of the property and you could only enter it with their permission.

When a property is being sublet, the owner is known as the head landlord, because now there are technically two with the tenant letting to the subtenant. The tenant they rent to is called the ‘mesne’ tenant, meaning intermediate and is pronounced as ‘mean’. The mesne tenant then, of course, rents to the subtenant.

Is subletting just lodging?

This is where many people become confused, but there are differences between subletting and lodging.

A subtenant and a lodger can both rent rooms. However, a subtenant can also rent an entire property rather than just part of it. The main difference here is that a subtenant has exclusive use of their rooms and the lodger does not. The landlord will need to give their permission before they can enter the subtenant’s rooms. On the flip side, a lodgers landlord can enter the lodger's room without permission and often does so to provide services such as cleaning.

If you share some of the accommodation with your landlords such as the bathroom or a kitchen, then the rights you have are similar whether you are a subtenant or a lodger. People who share accommodation with their landlord are generally known as excluded occupiers. This is a term which is often used in the housing to help to identify your housing rights. Excluded occupiers as such have very limited rights.

What happens if you sublet your home and you are not allowed to?

You will need to seek permission before subletting all or part of your home. If you are denied permission, you are not going to be legally allowed to do so. If you do anyway, then your landlord may take action against you if they find out. For example, they may take legal action to evict you for breaking the terms of your tenancy contract.

If you are in social housing and you sublet your home unlawfully, you will be committing a criminal offence.

What are the tax rules for double glazing windows?

Double glazing has long been a major concern for landlords and those who sell it since the early 2000s. It was announced way back in the 1998 Budget that from April 2001, a concession which was to allow landlords to offset general refurbishments at their properties against tax would be eliminated.

For many households, having double glazing will mean smaller energy bills and a warmer home. In fact, 51 per of people who were surveyed in a Which? report who had double glazing said that they did buy it to make their home warmer and to reduce their energy bills by 44 per cent.

Since the abolishment, landlords have not been able to offset refurbishments against tax. Instead, they can only claim for repairs, not improvements.

Furthermore, under these new rules, landlords would be able to get tax relief for something like repairing a broken window frame. However, if that window was replaced with double glazing, this would actually be considered an improvement and therefore it would not qualify to be claimed against tax.

Change in Rules

However, a tax case had forced the Inland Revenue to change the policy surrounding double-glazing. Double glazing does not qualify for tax relief and will even be backdated in some cases.

When the rule change came in, landlords could claim for windows which had already been installed as long as they met the deadline for making changes to their self-assessment forms. Now, any double glazing installed can simply be claimed on tax.

The Revenue stated that:

"In the past, we took the view that replacing single-glazed window with double-glazed windows was an improvement and therefore capital expenditure.

But times have changed... We now accept that replacing single-glazed windows by double-glazed equivalents counts as allowable expenditure on repairs."

The change was warmly welcomed by Malcolm Harrison of the Association of Residential Letting Agents welcomed the change. He said that: "It's good news for landlords and good news for tenants."

Glazing Over

Despite such good news for landlords, finding out whether “repairs” can be offset against tax can be rather confusing still, as many of the things done to a home can be classed as a repair and an improvement.

To shed some light, Mike Warburton, a partner at accountant Grant Thornton said that the system needs to be simplified. He said:

"It is confusing to know what is and what isn't allowable under the current rules.

"I accept that if the improvement is an extension or a loft conversion it may be unreasonable.

"But the logic is that if I am repairing and upgrading part of the facilities of the house, such as the kitchen, I don't see why it should not be an allowable repair."

Can you replace double glazing yourself?

Installing new double-glazing needs to meet certain building regulations. This needs to be approved by either an installer who is registered with a Competent Person’s Scheme or by a Building Control who can verify the work themselves. Because of this, it is not really advisable to try and install double glazed windows on your own. If you are a tenant, it is best to leave it up to your landlord to sort out.

A Guide on Inheriting a Property

Your property could be the most valuable thing that you own and if you do not have a partner or spouse, it is likely that you will want to pass on your home, flat or properties to your loved ones i.e children. However, what are the implications for someone inheriting the property? Is there tax involved? Do they have to continue making your mortgage repayments? Octagon Capital explains below.

The role of who gets your property falls under the guise of estate planning, which includes things like will writing, funerals and what happens to your estate. When you die, your property and belongings are typically handled by your solicitor that you have instructed and the executor of your will that you have allocated, who will be able to make sure that everyone gets their fair share.

Do I inherit the property immediately?

Yes, although do not worry that things are going to change overnight and you are going to be given heavy bills to pay. Most mortgage lenders are very lenient when it comes to inheriting a property and are willing to offer you a grace period to get everything organised and inheritance tax does not need to be paid for up to 12 months. Until the will is executed and you officially take on ownership, there is no one to collect from anyway.

What can I do with the property that I inherit?

Once the will has been executed, then you own the property and can do with it as you wish including sell it, rent it out or indeed live in it. You may find that you can make a residual income by renting it out to tenants or you may wish to make one lump sum by selling it outright when the market is performing well. You could also hang onto it as a long-term investment if you believe that it will go up even more in price.

In the event that you wish to do any development or refurbishment work on the property, you could look at bridge finance to provide a few hundred thousand pounds over 3 to 24 months. You may find that add an extension or conversion to the property could increase its value by 20% or more, helping you make a better return on the property you have inherited.

Who makes decisions about the property?

As per the will, it is the executor who makes the key decisions about the property and successfully passes it over to the recipient. The executor is usually someone that the deceased person knows but isn't necessarily in the will itself, otherwise it would impact their impartiality. So it could be a solicitor, in-law, friend or colleague. The executor is responsible for the payment of any tax, clearing any debts and distributing the estate to the beneficiaries as outlined in the will.

Do I have to pay the mortgage on a property that I have inherited?

If there is a life insurance policy for the bereaved individual, this can be used to pay off mortgage payments. If there is no life insurance policy or no money allocated, the responsible will lie on the person who has inherited the property to make mortgage repayments each month.

As mentioned above, you are not expected to make payments immediately, you are given a grace period. Of course, if the previous owner owned the property outright, then there is no mortgage and you simply own it 100% with zero payments.

What other costs are there for an inherited property?

In addition to mortgage fees, you may have buildings and contents insurance for any fittings, skirtings and belongings in the house. You need to be insured in the event of a fire, flood, theft or vandalism.

If you are not planning on living there, there are other forms of insurance that can be important such as landlords insurance if you are renting it out to tenants, or if you are leaving it empty, then it is things like unoccupied home insurance and second home insurance.

What tax do I pay on the property?

- Inheritance tax

- Income tax

- Capital gains tax

Inheritance tax

Inheritance tax on a property is huge. If the property is worth less than £325,000, then you are not required to pay anything. Once it is over £325,000, you are required to pay 40% of the value on top.

Income tax

Any revenue you generate from the property from renting it out to tenants is considered to be extra income and is taxable. Depending on how much income you make after costs such as mortgage fees and insurance, the amount of tax you pay will vary depending on the profit you make.

Capital gains tax

If you sell the property, and it has increased in value since you acquired it, you may be required to pay capital gains tax on the difference. This only applies on properties that are not your main residence of living. In some cases, it is better for the inheritor to move into an inherited property immediately, making it their main residence, in order to pay a lower rate of tax.

Ways to make your property more energy efficient

It is becoming increasingly more popular to make being energy efficient a priority in people’s lives. This includes making the home more energy efficient for the sake of the environment and in the hopes of saving a bit of cash in doing so. Both of these things are beneficial to you, your family and the world around you, so what are you waiting for?

With the colder months approaching, now is the perfect time to get on the road to checking your home is as energy efficient as it can possibly be to help keep those utility bills down this year. A survey which was conducted recently by Home Heat Helpline has found that

What can you do to make sure your home is more energy efficient? There are plenty of smaller and larger changes that you can make to ensure that you are doing it properly. In this guide on Bridging Loans, we are going to be going through the most popular and most effective ways alike to make your home the most energy efficient possible.

Insulate your Loft

A lot of heat from your home is lost from the roof, and if it is not efficiently insulated you could be practically burning money. The Department of Energy and Climate Change in the UK stated that British homes wasted around £500 million on pumping heat into their properties only for it to escape through poorly insulated walls and roofs.

With decent insulation, you could save about £160 per year on average. So this may be very worth your while in the long run.

Switch to Solar power

Solar panels in homes are becoming increasingly more popular as they can save you money and they also are very environmentally friendly. Many people

who opt for solar panels in the UK recognise that they do not work so well in the winter time so they use a combination of traditional means of energy and the solar energy during this period, which will save them a lot of cash in the process. However, it must be noted that no kind of weather can stop the panels from producing power at all – some energy will always be produced.

Solar PV panels are the most efficient. They generate energy and it is though that the average home could provide 40% of its power from these alone. On average, PV panels cost around £12,000 and last for around 30 years.

Solar energy comes at a high cost in the initial installation, but you are very likely to see a large return in the investment over the years.

Upgrade your boiler

Inefficient boilers could be racking up around £200 in additional cost to your energy bills. That means that upgrading your boiler could be a perfect way to cut down on what you are paying long term.

Keep an eye on your energy consumption

Are you aware of how much energy you are actually using and wasting? It may be wise to invest in an energy monitor, this only cost around £30 but you can actually get them for free from certain gas and electricity providers.

This will give you an idea of how much energy you are using that is really unnecessary. This can act as a wake up call and you may have the motivation to change habits such as leaving lights on and keeping the water running too long.

Research conducted by British gas highlights that having one of these monitors can help household to save as much as £110 a year simply by cutting back on how much energy they consume after becoming aware.

What to expect when working with a bridging loan broker

Octagon Capital is a broker which is designed to helping you find the best bridge finance for you and your requirements. The main advantage of working with a broker is that you get a full range of products from one place, rather than having to go to each lender separately trying to get the best deal. In addition, the broker only receives a fee if the loan application is successfully funded, so they will be determined to helping you find the best terms and lender most likely to accept your application.

We highlight what you can expect from working with Octagon Capital and similar brokers in the industry.

Phone Call

Once you fill in your details on our homepage or product page, you will receive a call back from someone in the SPF Short Term Finance team. This is our partner who are one of the most established mortgage brokers in the UK.

A team member will call you back to confirm a few details and understand your requirements better, so that we can be in the best position to place you with the lender who is most likely to successfully approve your loan application and deliver the terms you require.

Initial Application Form

Provided that your phone call with our staff member was successful and we can help you proceed, you will need to complete a short application form which requires you to fill in some basic details including:

- Name

- Occupation

- Loan purpose

- Loan amount and term

- Address (both current and address of property)

- Any other relevant information about your existing and future property

This information gives us an essential overview of your requirements and acts as a foundation for the loan that you wish to apply for. Assuming this meets the criteria of our initial lenders, we will pass this onto the next stage.

Indicate Quote

Your loan application will be put through a filter and returned with a number of indicative quotes from the lenders that we work with. Each lender has their own criteria and amount that they will allow you to borrow and the rate they charge. As a bridging loans broker, we can formulate this quickly and you will be given a quick overview of the loan amount and rates. Here is an example below:

Masthaven 80% LTV - £400,000 - 15 months

MT Finance 70% LTV - £350,000 - 14 months

Precise Mortgages 70% LTV - £350,000 - 8 months

Roma Finance 70% LTV - £350,000 - 7 months

As a borrower, you can decide which lender you would like to pursue or all of them in fact. You can then get your paperwork ready in order to proceed.

How to Proceed

The next step before we proceed is always a valuation of the property which determines how much it is worth according to today's market. The cost of a survey will depend on the size of the property, ranging from £300 to £1,200 to larger, more complex builds. The survey is always carried out by a RICS qualified surveyor and can typically be arranged within 2-4 days of enquiring.

The property's valuation is essential to ensure that it stacks up with the figures that you have provided and this may coincide with what the lenders have offered or cause them to change their loan offers.

Assuming everything is good to proceed, you are in a position to introduce your solicitors to the lender and allow the parties to liaise. To be approved for a bridging loan, you will need to provide additional proof of identity to the lender including your:

- photographic identification

- two proofs of current address (of over 3 months) such as a gas bill and council tax bil

Your solicitor will then prepare the mortgage deed and whilst some bridging applications can take a few weeks, there are many which can be arranged in just a few days.

What Fees You Can Expect

As a customer working with a bridging loan broker, it is important to know what other fees to expect with your application:

Broker fees: Depending on the broker that you use and the lender, there is a broker fee of 1% or 2% of the total loan value. For a loan of £500,000, this will therefore come to £5,000 to £10,000. This might seem like an additional cost of working with a broker, however, the broker may also help you get a lower interest rate and better chance of approval earlier on - so you may save money overall.

Arrangement fees: A lender typically charges arrangement fees which relate to the organising of the loan, the work of their solicitors and their administration. The cost of this is typically also around 1% to 2% and depending on the lender, may be a requirement before the loan is funded or it is rolled up into the full loan amount.

Valuation fees: The surveyor you use or is allocated to you will charge around £300 to £1,200 for carrying out a survey of the property. You can use your own surveyor provided that they are RICS qualified, however, a lot of bridging lenders will typically provide a surveyor for you.

Solicitor fees: Naturally, your solicitor is very involved with arranging the mortgage deed and receiving the funds from the loan. You will therefore have to incorporate your solicitor's fees into the mix and obviously having an expensive professional may impact the margins and your return on investment.

Early repayment fees: Bridging loans typically come with early repayment fees, with higher penalties in place if you want to end the loan agreement within the first few months. With this in mind, you need to weigh up the costs of repaying early or letting it run for a few more months and paying the interest.

What is classed as a new-build?

Due to the lack of property available across the country, the UK government is currently heavily incentivising new build homes, as well stating that in the next five years it aims to build over one million more new build homes. But what exactly is meant by a new build, and what is classed as one? We take a further look so you can make a more informed decision as to whether or not purchasing a new-build property is the right step for you.

What is a new build home?

In the simplest terms, this is defined as a property that has been yet to be purchased (it can still be occupied during this time_ within the first two years of being constructed, refurbished or converted. The new-build definition also extends to properties that have been bought off plan.

What are the benefits of new build homes?

There are a number of different potential benefits when it comes to deciding to purchase a new-build home. Here are some of the main reasons:

- The flexibility you have: as it is a new-build you do not have to worry when it comes to buying the process of being part of a chain, which can take a considerable amount of time and can also be quite stressful. It also means you have the flexibility to move at your own pace when it comes to sorting out the sale, and you have the flexibility when it comes to moving in, as you do not need to worry about waiting on buyers involved in an upward chain

- It comes with cover: it is possible that it is registered with the National House Building Council (NHBC) which will mean that you will be provided with a 10-year warranty and protection scheme too, which can help to provide you with peace of mind. There are also other companies that can provide insurance and warranties for new build homes, such as BLP

- Low maintenance: one of the best things about new-build homes is the fact you do not have to worry or get stressed out about maintenance, repairs or decorating when you first move in. In fact, it could mean that this kind of work will actually take place a few years down the line.

- Security: as a result of the high building standards now in place for all new-build homes, you can be safe in the knowledge that the property is safe. For example, most new-builds come with locks on doors and windows, fire safety, security lighting and in some places entry phones

- Getting in early: a number of housing developers and builders provide properties off plan, which means you have the potential to reserve your dream home prior to it being built. Furthermore, you could also end up potentially benefit from equity growth before you've even moved into the property if you manage to buy off plan in a location where house prices are on the rise.

- Bills are less expensive: another positive of new build properties relates to the reason that new builds are usually built and fitted with the very latest energy efficient appliances. That means then for you as a homeowner, they will most likely be cheaper to run than older properties, and they tend to be triple glazed or well insulated.

Schemes for new build homes

As well as potentially taking out bridging loans, there are support and schemes available for buyers who are interested in purchasing a new-build property.

Help to Buy

There are two parts to the Help to Buy Scheme. This is an initiative that enables first-time buyers and existing homeowners in England to buy a new home or an older property. There are also schemes that work in a similar way in Wales, Scotland and Northern Ireland.

It is worth noting there are two parts to the Help to Buy scheme:

- The equity loan: this can only be taken out for new-build homes only, and requires the buyer to have a deposit minimum of 5 per cent, with the government then providing a loan equal to 20 per cent of the value of the property.

- The mortgage guarantee: the second part of the Help to Buy scheme is where the government provides lenders with the opportunity to buy themselves a guarantee on mortgages (available for both new-build properties and older, resale homes too). That allows mortgage providers to then provide a greater number of high loan-to-value mortgages to borrowers as a result of this kind of insurance.

Starter Homes

Another government scheme pertains to the Starter Homes initiative. This is a pledge by the government to build thousands of homes at a discount to first-time home buyers who are between the ages of 23 and 40. However, at this moment in time, there have been no properties been built.

Shared ownership scheme

With this scheme, buyers who fit the eligibility criteria are able to purchase a percentage of a property (anywhere from 25 per cent to 75 per cent in total) of a new -build house from a local housing association. Over the course of time, they then pay rent that relates to the percentage of the property you do not own. Eventually, you will end up owning all of the property.

Increasingly, developers and house builders are offering their own incentives to buyers. These may include any of the following:

- Paid deposit

- Part-exchange deals, where your existing home is bought from you by the developer and then sold on

- Assisted sales, i.e. helping you to sell your existing property

- Free fixtures or fittings

- Paid Stamp Duty Land Tax

- Cashback

The Real Benefits Of Becoming A Buy-To-Let Landlord

The number of completed buy-to-let mortgages in London rose by 8.97% in Q2 of 2018, according to Commercial Trust. This is great news for the market as lending for buy-to-let properties previously shrunk by 10%. And it’s not just London which has seen a growth, as the North-West has also seen a jump, taking an 11.11% share during Q2.

Therefore, if you're looking to buy a property, it's worth considering the rental potential of it as there are some great benefits in buying-to-let, including being able to utilize a bridging loan to fuel your new business venture.

Anyone can do it

One of the best things about buy-to-let mortgages is that anyone can obtain them. If you’re an existing homeowner or a first-time buyer, purchasing a property for rental purposes is a great way to make an additional income. Self Certification buy-to-let mortgages allow individuals, such as homemakers or those on a low income to benefit from obtaining and renting out property.

Some buy-to-let landlords even manage to replace their earnings with the profit they make from their portfolios. And, if you do require financial help to refurbish your new property before renting it out, be sure to consider a bridging loan to assist you with your requirements.

Pay off your mortgage and have cash left over

Research conducted by Halifax reveals that the average monthly mortgage repayment is £669. Meanwhile, the BBC reports that the average monthly rental cost in England and Wales is £926. Therefore, buy-to-let landlords benefit by paying off their mortgage and having a significant sum of cash leftover to do with as they please each month. As a result, these additional funds can be used to help you pay back your bridging loan.

Investment opportunities throughout the UK

Traditionally, landlords would purchase properties to rent out close to home as this would give them optimum control of the property. However, investment opportunities are available throughout the UK, with some areas providing greater financial benefit.

Typically, house prices in London and in Southern England are higher than up north. And, with a 3% stamp duty surcharge for landlords owning more than one property, as well as the revelation that the autumn budget will hike stamp duty up further, profits will be hampered, making it difficult to pay back your bridging loan. But, by buying further north and allowing your letting agent to take over the day to day running of your buy-to-let property, your stress levels and your bank balance will be boosted.

Tax relief

There are numerous ways to save on your tax bills as a buy-to-let landlord. Following the announcement in 2015 that tax relief on rental properties was being overhauled, an increasing number of landlords moved their portfolio of properties into a company to lower their taxes. Moreover, buy-to-let landlords can offset costs against tax, including letting agents’ fees, mortgage interest payments, advertising and repair bills, all of which can help you pay back any outstanding financial agreements.

Buy-to-let landlords can benefit in many ways by investing in property for rental purposes. One of the biggest pros is that almost anyone can do it and there’s a significant amount of profit to be made. Furthermore, investment opportunities are available throughout the UK and there are various ways to save on tax, too.

What is property crowdfunding

Property crowdfunding is somewhat new on the property scene and could become another popular way of providing finance for properties in much the same way that bridging finance lenders have come to dominate the sector. For example, in a 2016 report by think tank Nesta, it was reported that property crowdfunding via p2p loans had raised an astonishing £609 million, with a further £87 million through other equity crowdfunding platforms. So, how exactly does this kind of investment work? We explain everything you need to know.

Property crowdfunding

Property crowdfunding essentially brings together technology and platform based peer to peer lending. Companies who have created crowdfunding platforms for property investment in the UK allow investors to pool money together. This then allows everyone to get a share of the property which can then be bought. These shares are calculated based on how much each individual investors contributes to the investment pot. That essentially creates what is known as a special purpose vehicle (SPV) which is advantageous, as it means that it can have as many shareholders as it wants, or as many as are willing to help fund it.

What happens next?

The next stage of this crowdfunding model is that the building bought through this platform is then rented out. Each person with a share also gains a share of the rent.

Any fluctuations in the house valuation can also determine the value of your shares as well. That means that being an investor under this model can be particularly lucrative, as not only can you benefit from the rent share, but also if the value of the property rises over the time. That means you also get a share in the capital growth too.

Furthermore, getting involved in property crowdfunding is relatively stress-free in terms of your commitment and overall day-to-day involvement. For example, with some property crowdfunding models, you can invest as little as £30 to £50, without having to worry about all the aspects involved in the typical buy-to-let model, such as having to deal with tenants, property management and other issues.

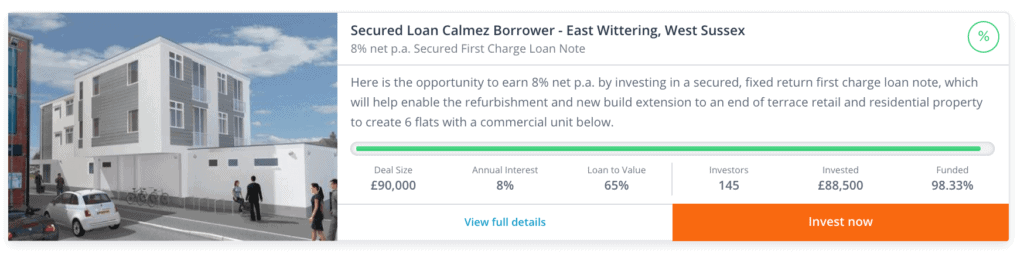

Here is an example of property crowdfunding below from Property Moose:

How can I get into property crowdfunding?

There are various routes to property crowdfunding for those who are interested. For example, some people decide to get involved through bonds, loans or equity.

Furthermore, people are not limited in terms of the kind of property they can invest money in. For example, it is possible to invest in just commercial or residential property. Or if you so wish, you also have the option to invest in both at the same time.

Nevertheless, if you do decide to invest in both commercial and residential property, it is worth remembering that both have different elements of risk involved if you decide to contribute to either.

There is also the option to fund building projects from the construction phase all the way to sale. You could also get into bridging loans over the short term, as a way of then accessing higher returns over a longer period of time.

Advantages of property crowdfunding

As previously stated there are a number of different advantages to crowdfunding. For example:

- You have much more choice and therefore greater freedom when it comes to how you invest

- There is less commitment involved compared to other types of property development that you could invest in such as buy-to-lets

- It allows people to build a property portfolio and diversify quickly at a much faster rate than other types of investment

- It allows people to engage in buying multiple properties (from residential to commercial) without the need for having a huge amount of capital up front, again, this is not always possible with other kinds of investment

- Each SPV owns a single property, and therefore it is completely separate from the platform itself

Disadvantages of property crowdfunding

- Like any other kinds of investment products, there are risks involved and the property crowdfunding market varies from project to project. Therefore, you should always make sure that you have done plenty of research before deciding which platform you want to invest in, or a number of platforms

- Remember that there are also fees involved which can end up being quite costly. For example, many property crowdfunding models will charge you an initial finder's fee. The exact amount that you will pay will depend on the platform that you opt for, but you can expect to pay anything between 5 and 10 per cent. These are costs that you should be factoring in when you decide whether or not property crowdfunding is the right investment for you

- Furthermore, some will also require you to pay on top of an initial finder's fee a management fee on the yield too. You can expect to pay between 10 and 25 per cent for this.

- There may also be a capital gains fee of another 15 per cent, but this is not necessarily the case between all the platforms.

How does capital gains tax on property work?

You will be required to pay capital gains tax, which is the tax that is payable if you have profited from the sale of an asset, in this case, this is your property. However, did you know that this type of tax works differently if you are selling property than it does if you were selling assets such as stocks and shares? This can mean capital gains tax appears more complicated than it in fact is. Octagon Capital explains the vital points you need to know concern capital gains tax on property.

Not everyone pays capital gains tax on property

If you have made gains on your only (or principal) home, it is not usually the case that you will need to pay capital gains tax on it. However, it is likely you will have to pay if you own more than one property.

How do I know if I owe capital gains tax on property?

As previously stated, if you are selling the main home that you are currently residing in, it is usually the case that you are exempt from paying capital gains tax due to a tax relief system that is implemented in the UK, known as 'private residence relief'.

Nevertheless, things change if you are selling a home that you are currently letting out, or if you are intending to sell a second home. There may be ways though that you can reduce your capital gains tax bill (through accessing tax relief) or by deciding to nominate which of your property you would like to be tax-free. So if you are using bridging loans in order to build up a second property and sell it for more, you will likely pay capital gains tax on this.

When will you need to pay capital gains tax on property?

In summary, here are the following situations where you will most likely be required to pay capital gains tax on a property:

- You use part of your property only for business-related matters

- You purchased a property specifically for the intention of renovating it and then selling it on

- You have moved out of the property for a period of least 18 months, perhaps as you have moved into your partners home

- You have let out a part of your home, or all of it. This does not include if you have a single lodger, as to count not as a tenant you would also need to be living in the building too

- If you sell your total plot (or part of your garden) and including the area you are selling off equates to more than 1.2 acres in size

- You are in property development and are converting a property into flats

Capital Gains Tax rates for property in 2018-19

It is important to be aware of the fact that a proportion of the profits that you make from selling a property can be earned completely tax-free. This is known as being your capital gains tax allowance.

That means that for the 2018/19 tax year, you are able to make £11,700 in profit before you will be liable to pay capital gains tax. This rises to £23,400 if you are married or in a civil partnership.

When it comes to the capital gains tax rates you will pay on the property after this threshold, it will be depending on which tax band you fall under. For example, if you are a basic rate taxpayer, this will mean you will need to pay the equivalent of 18% on capital gains tax for property gains. For higher-rate and additional-rate taxpayers, this rises to 28%.

The tax you need to pay for a second property

You have the option of deciding which home will be tax-free if you use more than one property, and it does not necessarily have to be the property you live in most of the time. You will have a time-frame of two years once you have purchased a property in order to make this nomination. Typically, people in this position decide to nominate the home they expect to make the largest gains when it comes to selling it off.

It is also worth remembering that those who are married or in a civil partnership are only able to have one main home between them. However, couples who are unmarried have the options to each nominates a different home if they so wish.

How does capital gains tax work on gifted or inherited home?

Perhaps you are in the scenario where someone has left their property to you in their will, or your parents or relatives have the intention of giving you the property at a later date. Does this mean you pay capital gains tax?

In this situation, you will inherit the home at its market value at the time of death when you inherit it. Whilst there is no requirement for capital gains tax to be payable on death, the value of the home will, however, be included in the estate (for clarity, this refers to any assets and property taking away the cost of funeral expenses and debts) that will then mean that inheritance tax may be due instead of capital gains tax.

However, you may be liable to pay capital gains tax in this situation if you sell on the property without having made it your own residence, which would otherwise exempt you through private residence relief. If you do pay, the amount you will be required to give will be calculated on the increase in value between the date of the death, as well as the date you sell the property, taking off associated selling costs.

If you fall under the 'gift with reservation' category, (for example, you are provided with a property whilst the homeowner still lives there) you may have to pay capital gains tax if you sell the home. You could also still have to pay inheritance tax too once the gift giver passes away.